The trade analyzer provides an easy way to customize any options strategy with additional legs from the same expiration. This enables you to explore how different combinations and quantities of options can be used to structure your preferred payoff.

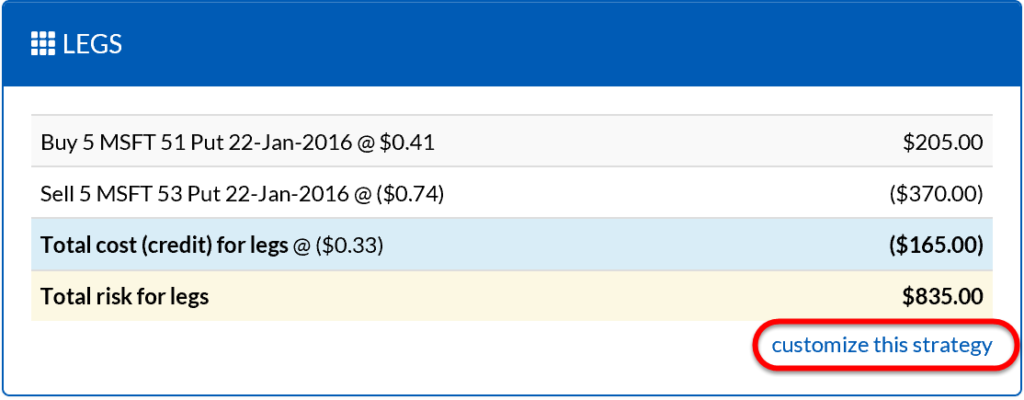

To customize a strategy, locate the Legs panel in the trade analyzer view. Click the customize this strategy link to begin the customization process. Note that while the Legs panel uses absolute quantities for each leg, the customizer works with ratios. For example, the trade above has a quantity of 5 contracts for each option leg. This reduces to a 1:1 ratio when the customization is invoked.

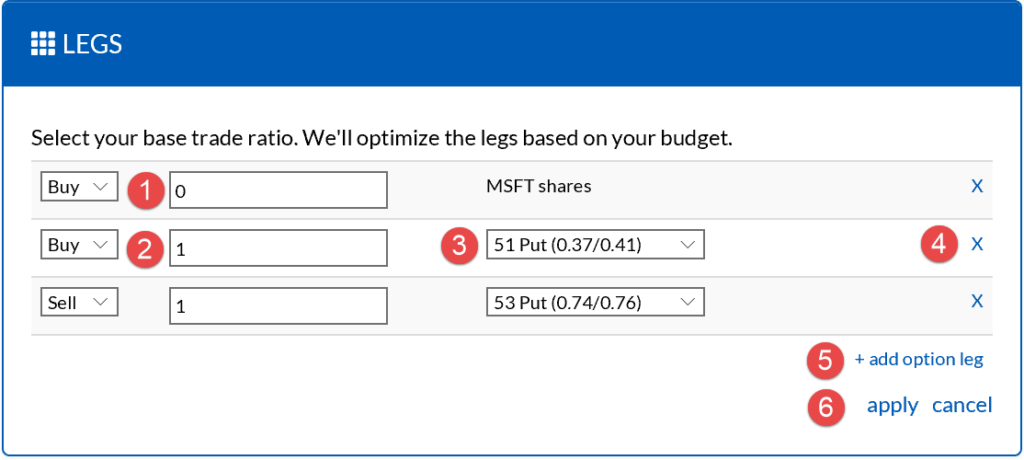

- If you want this strategy to involve shares of the underlying, select the buy/sell and enter the quantity here. Keep in mind that the shares are also subject to the same ratio rules and that option contracts typically represent 100 shares. For example, a covered call trade would use the ratio of 100 shares and -1 call contract.

- For each option leg, select whether you want to buy or sell that option, as well as how many contracts to include per base unit. The software will optimize the actual number of legs based on your configured budget when you apply the changes.

- Select the specific options used in this trade. The format used in the drop down is Strike Type (Bid/Ask).

- You can remove a leg altogether by clicking the small x on the right side of its row.

- You can also add an arbitrary number of legs.

- When you’re done, don’t forget to click the apply button to see the results. Alternatively, you can click cancel to reset the trade to its previous ratio.