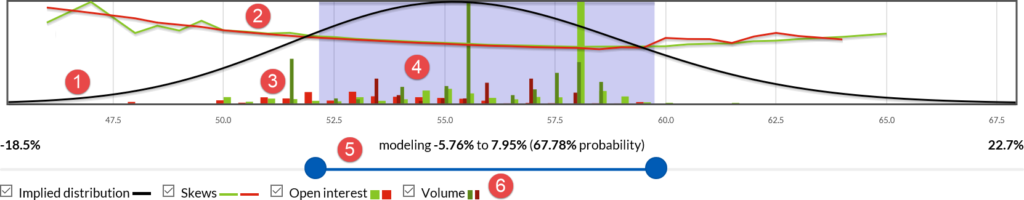

The visual options chain provides a great way to absorb all of the important information an options chain provides in a single condensed view.

The chart above provides an incredible amount of insight as to the market expectations and activity for this expiration.

- The black curve at the back is the implied distribution. This represents the relative likelihood of a given close versus another at expiration. As you move further from the center, the movement becomes less likely.

- The green (call) and red (put) lines represent the relative implied volatility skews.

- Each strike has four bars that represent:

- Current call open interest (wide green)

- Today’s call volume (narrow dark green)

- Current put open interest (wide red)

- Today’s put volume (narrow dark red)

- The shaded area is the area of the current model.

- You can drag the sliders at the bottom to customize the model. It will update both the range and the percentages so that you can understand the nature of the movement being factored into the customized model.

- You can use the checkboxes at the bottom to show/hide various graph components.