The Calendar Search provides a great way for investors to identify a great calendar spread for their market view. It’s a very simple process, and yet it also provides an incredible amount of flexibility and customization.

Select your stock

The first step in the process is to select the stock you want to work with. You’ll start off on the dashboard, which provides direct access to different features. Enter the symbol you’re interested in searching against to start the process.

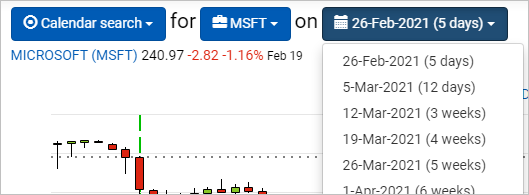

Select your time horizon

Since calendar spreads use options with different expirations, there isn’t a clean way to model the exact valuation for a trade on a future date. However, accurate estimates can be generated for dates up until the expiration of the near-term leg. Use the target date dropdown from the top of the screen to select the date you want to analyze for. Just keep in mind that the calendar search will only consider options that expire on or after this data.

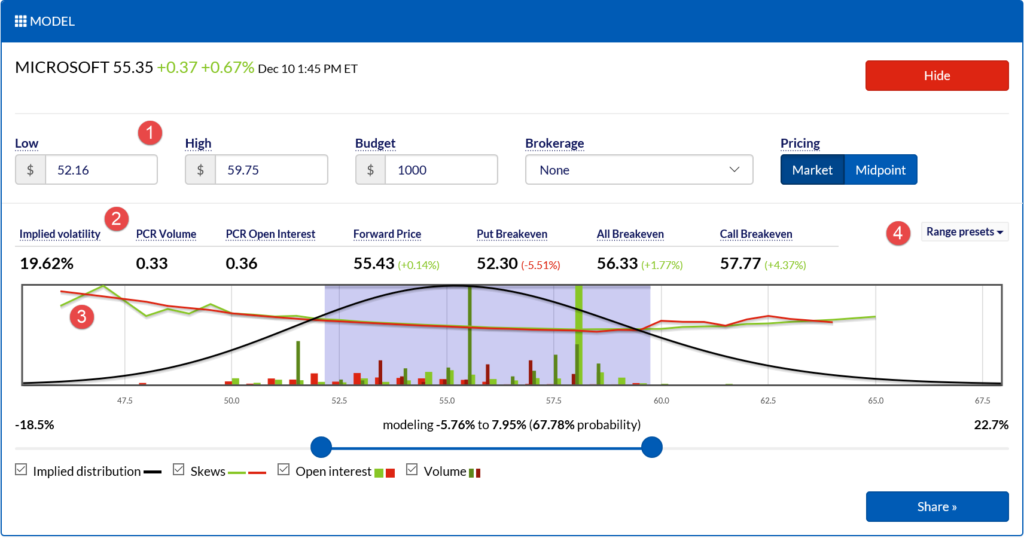

Model your view

Where do you expect the underlying to close on your target date? Simply enter the range you’re anticipating and the calendar search will use these parameters when modeling trades. In addition to providing the latest option analytics for this expiration, the model designer provides fresh market data and also includes the visual options chain, which offers insight as to market activity for each strike on this date so that you can tweak your view in consideration of how others are trading.

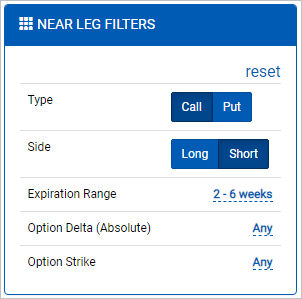

Define the near leg filters

The near leg is the leg of your trade that expires first. First, define the Type and Side of the leg, such as a long call, short put, etc. Next, define the Expiration Range for the options to consider. The expirations are filtered based on a window relative to this week. For example, a 2-6 week window means that options expiring after two weeks, and up until six weeks, from this week. To include this week’s options, use 0 weeks as the minimum. The expiration range is defined relative to “this week” so that search templates can be saved for future runs without having to manually move the dates out each time.

Define the far leg filters

After defining the near leg filters, it’s time to define how the far-dated leg should be selected. Like the near leg, the far leg has options to select the Type and Side. However, some of the filters are different in that they are applied relative to the near leg, such as the Expiration Offset. For example, an expiration offset of 4-8 weeks will filter out options that don’t expire 4-8 weeks after the near-dated option being considered on an option-by-option basis. In other words, this filter could produce one trade with a 2-week near leg and a 6-week far leg, as well as a 6-week near leg and a 14-week far leg. However, it will not include a trade with a 2-week near leg and a 14-week far leg because that 12-week offset is outside the defined range.

Define the trade filters

Trade filters are available to refine results based on net Greeks per contract. This makes it easier to locate trades that zero in on views based on the movement of the underlying, volatility, interest rates, and more.

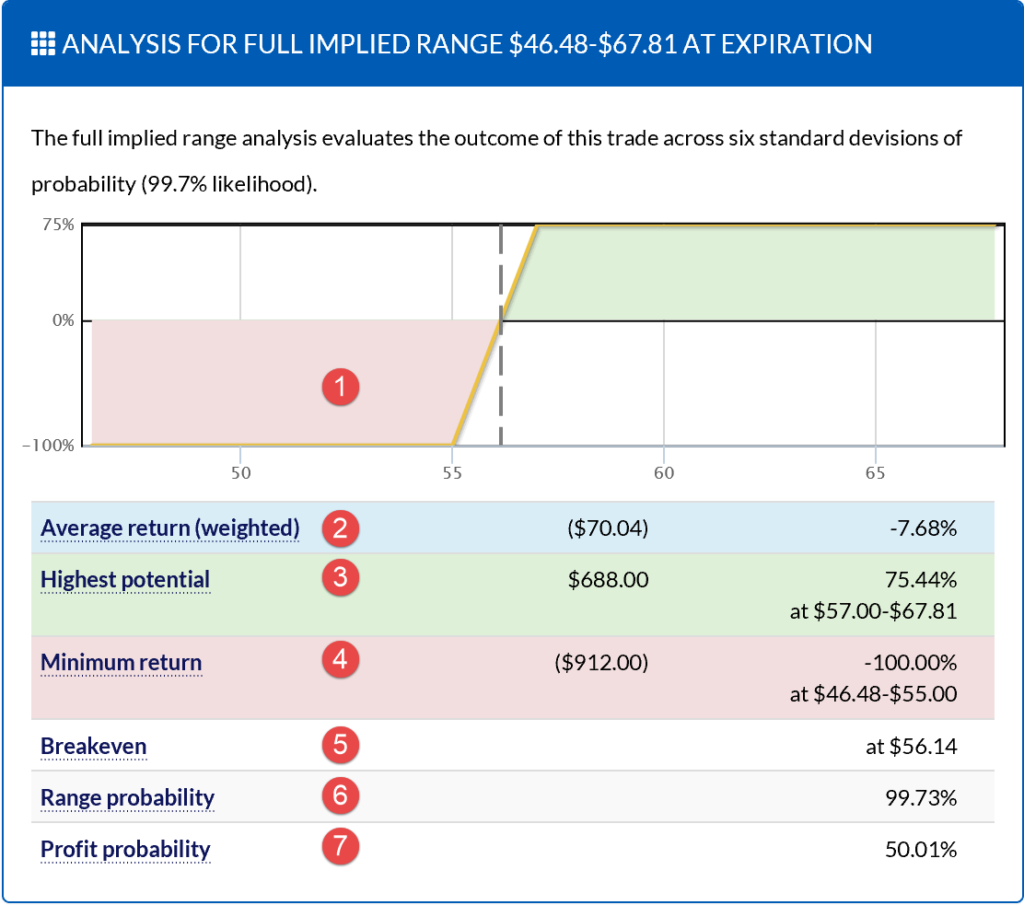

Analyze the trade in depth

Click through interesting trade opportunities to review the trade in depth. The trade analyzer provides a thorough review of the target trade, including a risk-neutral trade analysis and consideration of the full implied range the underlying is expected to close in.

Check out the Calendar Search in action.