When searching for options trades, it’s important to filter out anything that doesn’t meet your risk/return goals or preferred investment approach. The provided set of filters offer a significant amount of flexibility and can help you zero in on the exact trade you’re looking for.

Each filtering feature is presented on the left side of the screen and is grouped in three key categories: Sort By, Strategies, and Filters.

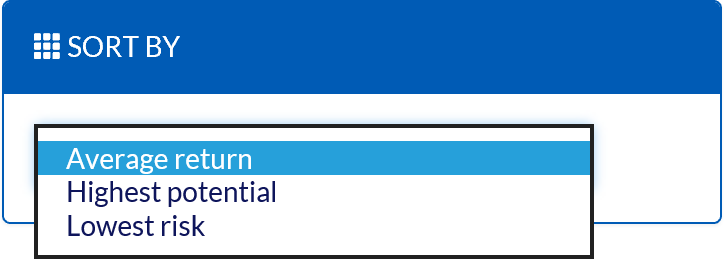

Sort By

The SortBy drop down enables you to sort the results in the following orders:

- Average return sorts the trades using a linear average return where each price point within the model is weighted equally.

- Highest potential sorts the trades based on the highest potential performance within the model.

- Lowest risk sorts the trades by the lowest potential performance within the model.

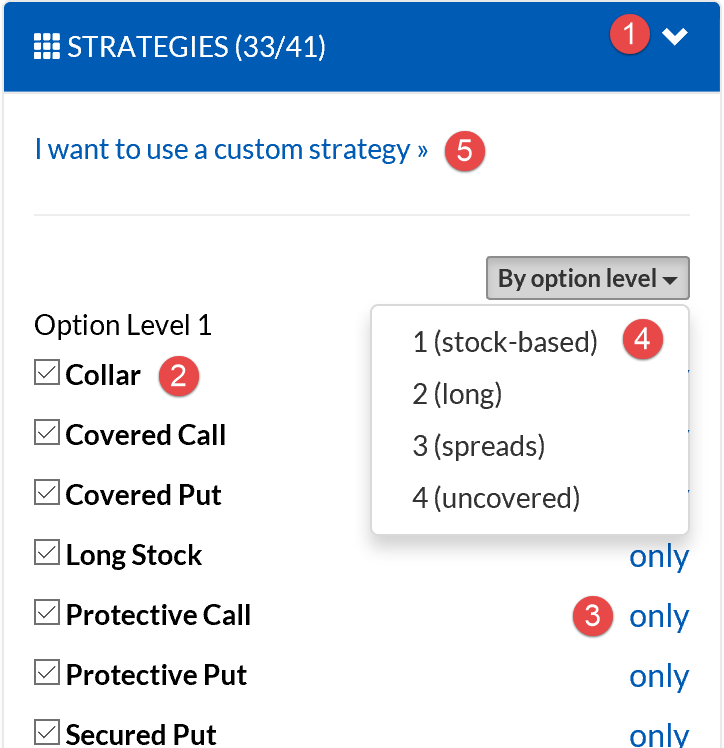

Strategies

The options search supports dozens of basic and sophisticated trading strategies. Depending on the risk and/or leverage enabled by a given strategy, your broker will assign the trade type to a category, which will typically be on a scale of 1-4 (or sometimes 5). In order to open a trade using a given strategy, you account must be enabled by the broker for that level. The Strategies filter organizes these trades by option level and provides an easy way for you to determine exactly which strategies you would like to include in the search.

- By default, the Strategies filter is collapsed. Simply click the group to expand it.

- To enable a strategy, check the box next to its name. To hide all trades that use that strategy, clear it.

- If you would like to only use one specific strategy, you can use the only button on the right side of the panel.

- If you would like to include all strategies for your options trading level, you can use the By option level drop down to select that level. It will then include all strategies at that level and below.

- If you would like to skip the search and manually enter a custom options strategy, you can click the custom strategy link at the top.

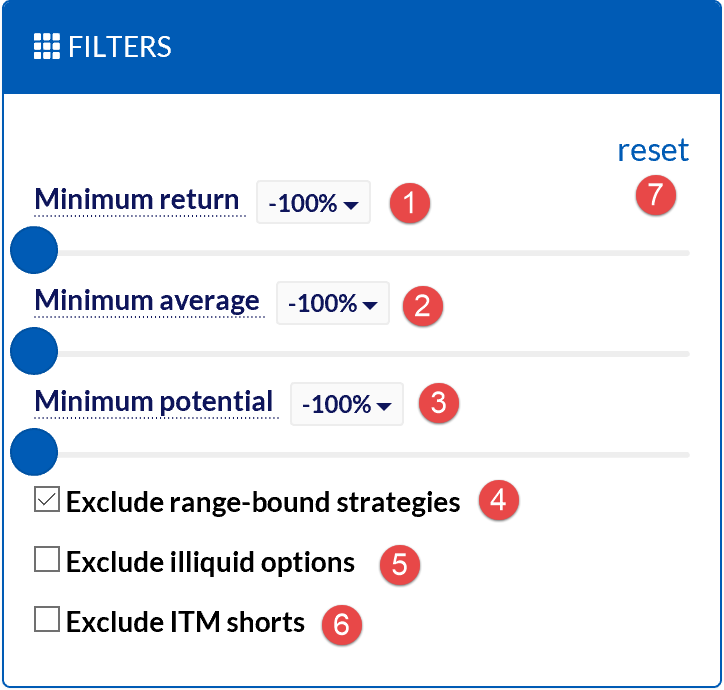

Filters

- The Minimum return filter will remove all trades that don’t return at least the specified rate for every price point within the model price range.

- The Minimum average filter will remove all trades that don’t have a linear average return that is at least as high as the specified rate within the model price range.

- The Minimum potential filter will remove all trades that don’t have the potential to return at least the specified rate at some point within the model price range.

- Exclude range-bound strategies will hide all trades that have positive returns bound within a price range. For the purposes of searching, trades that have the potential to decline for price points above and below the peak return are considered range-bound. This filter is particularly useful for directional trading, such as when you expect the underlying to be above (or below) a given point, but you don’t care by how much. For example, a bull spread is not considered range-bound because it will return the same rate once it reaches its peak price point, and the return will not decline if the underlying continues to move higher. A straddle, on the other hand, is range bound because it continues to decline in value as it moves further above or below the peak price point. By default, this filter is enabled.

- Exclude illiquid options will hide trades that include an option that is illiquid. For the purposes of search, an option is considered liquid only if the bid is within 5% of the ask (or if the spread is $.01). Options without bids or asks are automatically illiquid.

- Exclude ITM shorts will exclude trades that involve selling options that are in-the-money. Investors often avoid these options because they carry a risk of assignment, which can produce additional risk due to dividends.

- The reset option will reset these filters to their default state.