The Options Search Engine (OSE) provides a great way for investors to identify a great options trade for their market view. It’s a very simple process, and yet it also provides an incredible amount of flexibility and customization.

Select your stock

The first step in the process is to select the stock you want to work with. You’ll start off on the dashboard, which provides a variety of popular lists, such as stocks with unusual performance, upcoming earnings announcements, or ex-dividend dates. You can also enter the name or symbol of any optionable stock you’d like to work with.

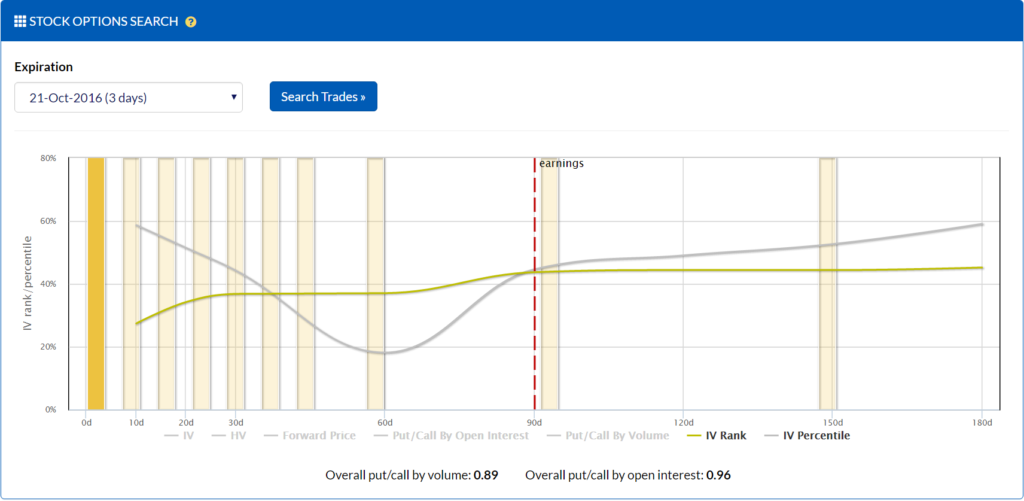

Select your time horizon

Next, you’ll select a time horizon (expiration) for your trade. If you’re looking to play earnings or recent news, you may want to find a near-term expiration. On the other hand, if you’re following analyst advice or fundamental analysis, you may look for a trade that matures further down the road. The expirations chart offers a great visual way to select your time horizon based on a variety of analytical factors, including volatility, forward pricing, and put/call ratios. You can also see the stocks with the highest correlation to your target stock for alternative opportunities.

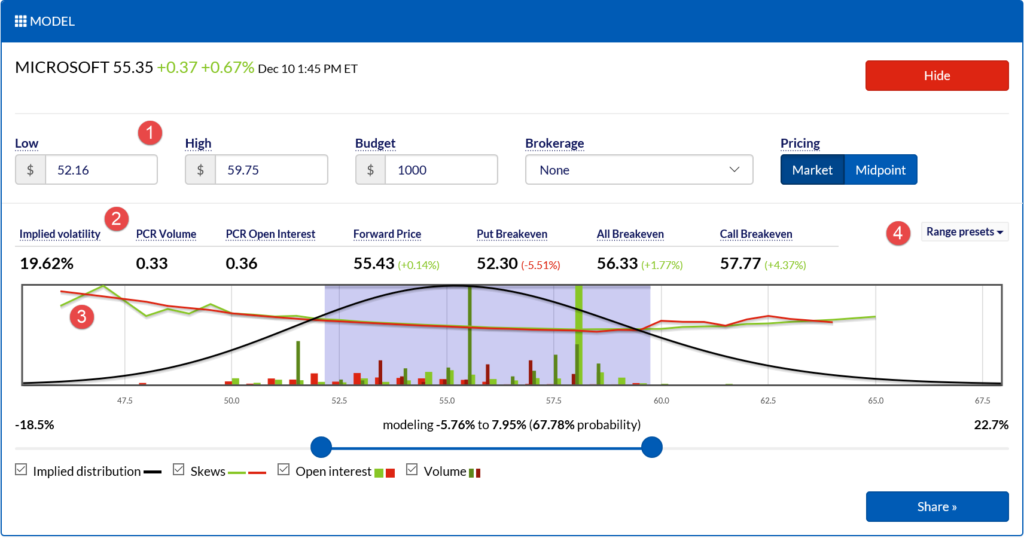

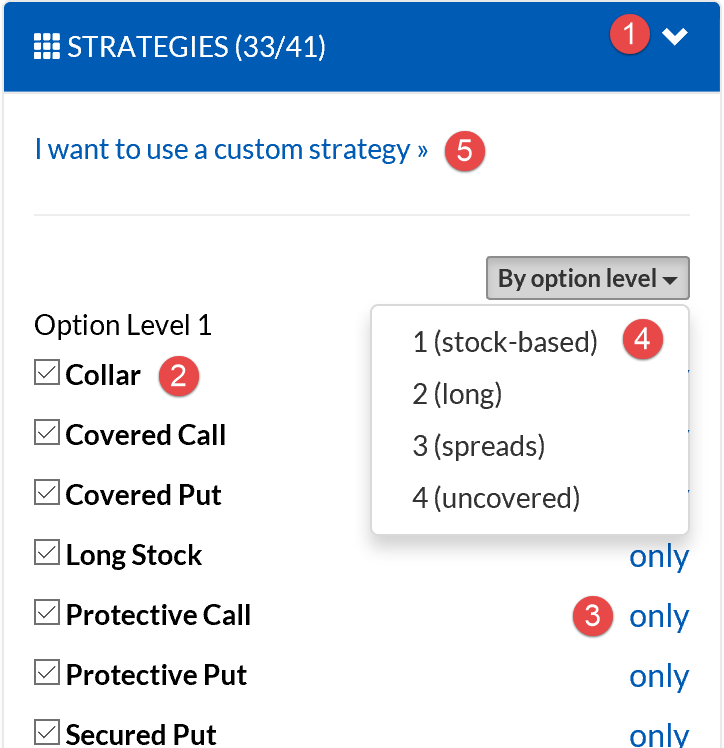

Model your view

Where do you expect the underlying to close on your target date? Simply enter the range you’re anticipating and the search engine will generate optimal trades using dozens of basic and sophisticated strategies. In addition to providing the latest option analytics for this expiration, the model designer provides fresh market data and also includes the visual options chain, which offers insight as to market activity for each strike on this date so that you can tweak your view in consideration of how others are trading.

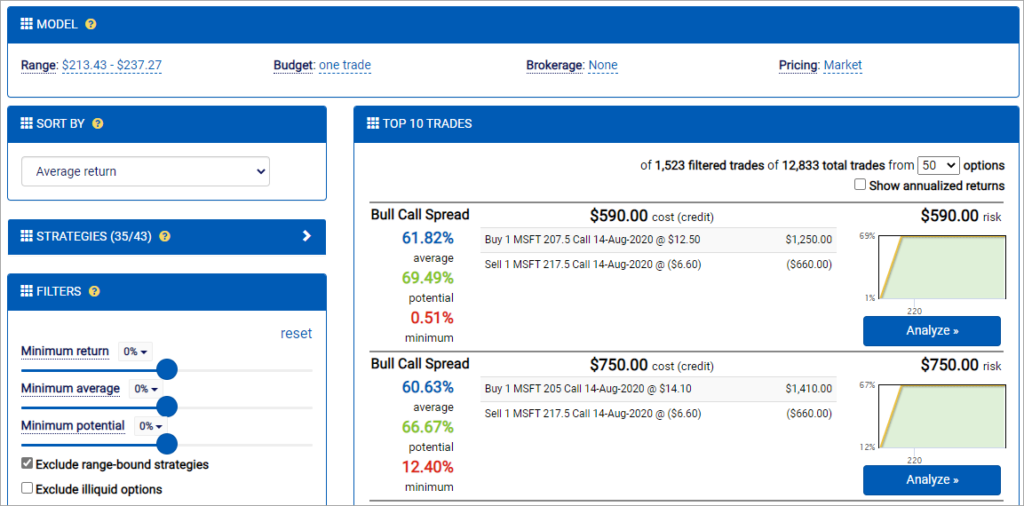

Filter and sort the results

There are many ways for you to customize your search results based on your risk & reward goals. First, entering a budget will ensure that only trades that have the investment basis (debit cost or credit margin) you can afford. You can also select a brokerage to model transaction costs (commissions & fees) into the analyses. You can also filter out trade ideas that don’t meet return requirements, such as requiring all trades to return at least 10% for your view, for example.

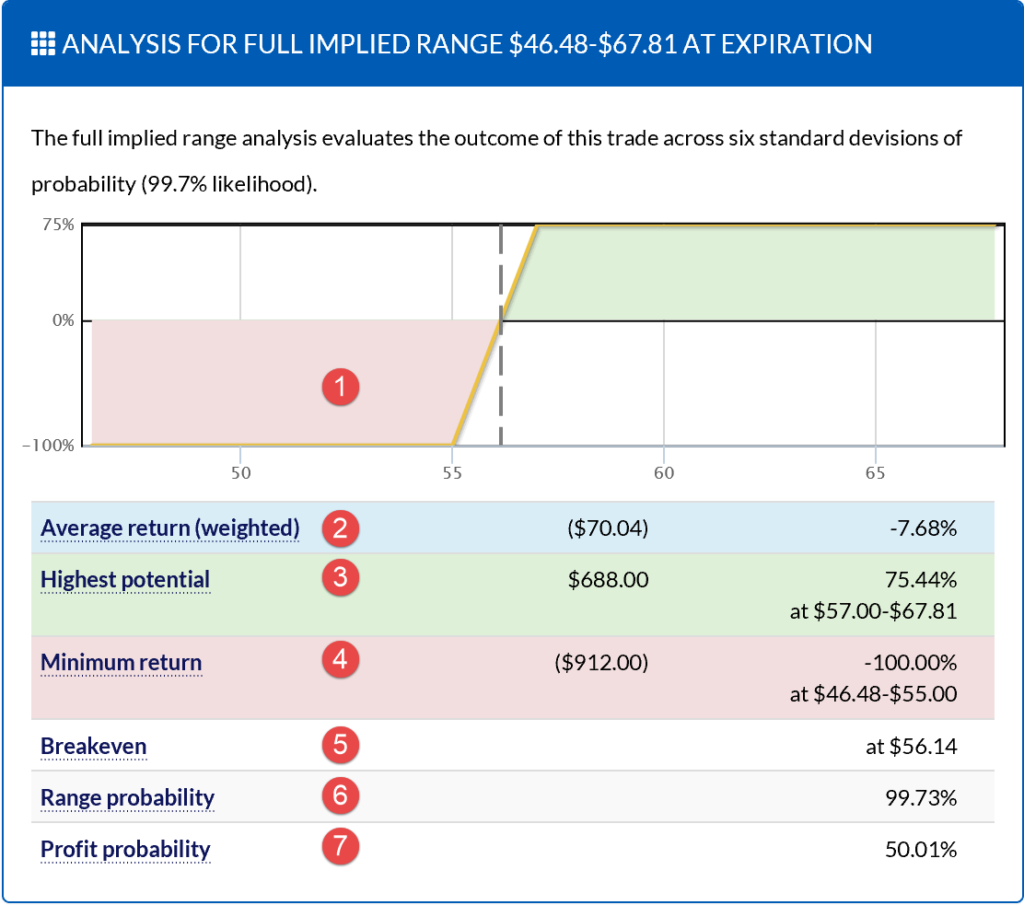

Analyze the trade in depth

The trade analyzer provides a thorough review of the target trade, including a risk-neutral trade analysis and consideration of the full implied range the underlying is expected to close in.