Monitoring a portfolio with Quantcha

Quantcha provides two major features to help investors monitor strategies and the market: the portfolio manager and Quantcha Alerts.

Portfolio manager

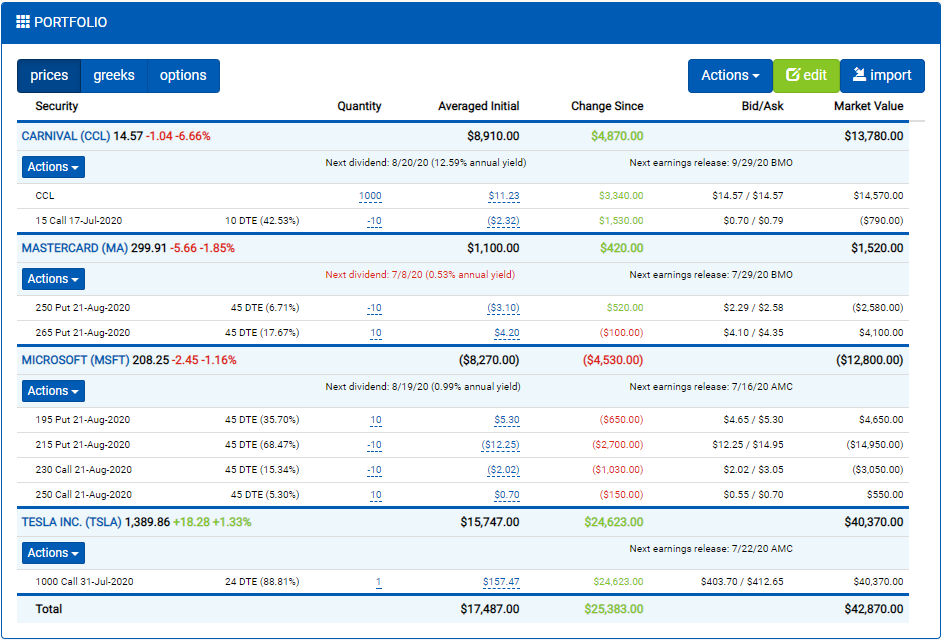

The portfolio manager provides an overall view of an account’s holdings. It offers three views optimized for different purposes.

- The prices view highlights the market value of each position in both per-share and total dollars.

- The greeks view includes metrics like delta and gamma (both per position and beta-weighted), as well as theta, vega, and rho.

- The options view breaks down option positions by implied volatility, intrinsic value, time value, and current liquidity cost.

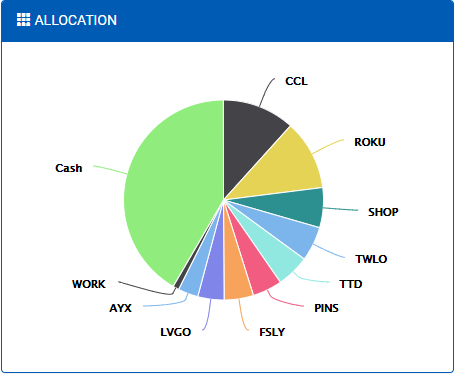

You can also visually keep tabs on your portfolio allocations (including option positions). This can be a useful tool in ensuring a comfortable ratio of cash to investments, as well as the specific allocations per underlying.

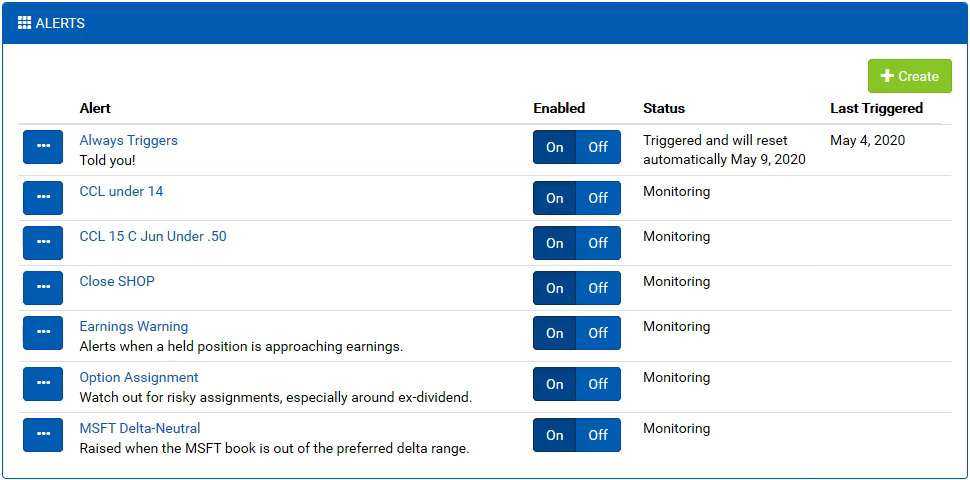

Quantcha Alerts

Quantcha Alerts is a notification service provided by Quantcha that helps you track market, trade, and portfolio data. You can use it to set up timely alerts for key market events, such as when a stock crosses a price threshold. You can also use it to remind you when one of the stocks in a portfolio is approaching an earnings or ex-dividend date. You can also create an alert to notify you when the delta for a given option book exceeds an allowable range.