Planning a trade with Quantcha

Quantcha provides tools that excel in helping investors plan and manage the trades that drive an investment strategy. This topic will primarily focus on trade entry planning, and the later topic on adjusting positions will focus on managing existing holdings.

Planning typical strategies

Most option trades, even those with multiple legs, follow standard strategies. These strategies generally use options expiring on the same date and follow conventional ratios to ensure risk is well-defined. Quantcha offers specialized tools for locating and optimizing these trades.

Options search engine

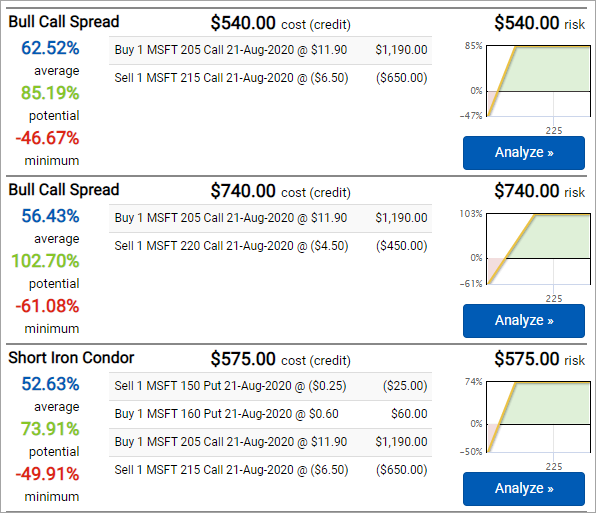

Quantcha’s options search engine was the first of its kind. It allowed investors to express their views by specifying a stock, an expiration, and a price range. From there it analyzed dozens of potential strategies to determine the best way to trade a view.

The options search experience has evolved over the years to become an indispensable tool in finding the best way to play a given view. You can filter and sort by a variety of properties, including the expected value of a trade relative to the view.

Trade strategy screeners

Investors looking to express a strategy-centric view, such as selling covered calls, can choose from over a dozen global screeners that focus on popular strategies. These screeners allow for complex filtering and sorting scenarios that include details about the underlying stocks, probability of profit, option Greeks, and more.

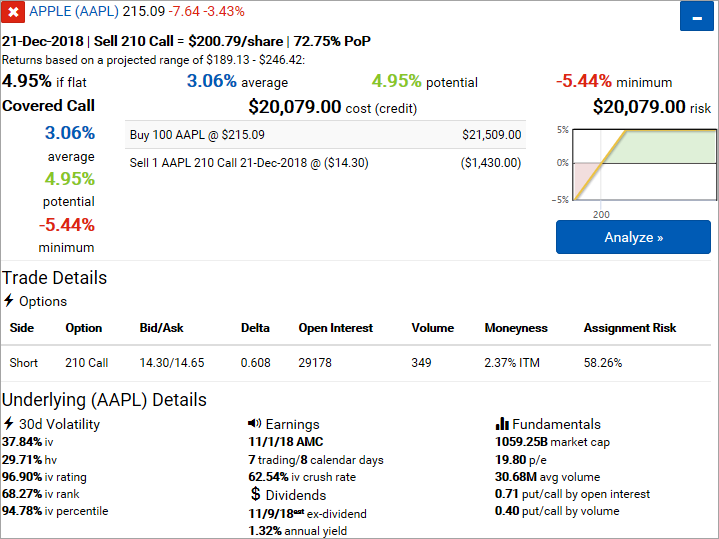

Trade analyzer

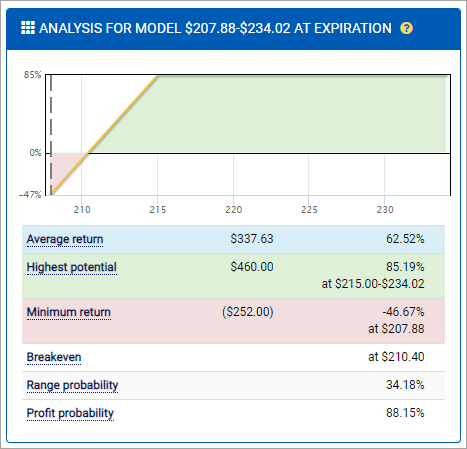

Trades uncovered by the options search engine and strategy screeners lead into the trade analyzer. This tool provides an in-depth review of the trade being considered. It also performs a series of trade checks as part of a risk-neutral review designed to raise awareness about potentially unknown risks, such as upcoming earnings or dividend dates. Investors can also adjust the view being modeled to determine the risk/reward profile for the trade under different terminal pricing circumstances.

The trade analyzer also allows investors to specify a trade budget and adjust the entry plan to offer the optimal leg quantities for that view. It’s even possible to tweak leg strikes and ratios to determine how those changes would impact the expected result.

Planning complex entry strategies

Most option trades are best served by the tools discussed above. However, sometimes a trade entry plan is a little more complex. If a trade entry includes on one or more of the following factors, then special considerations need to be taken:

- It involves options that expire on different dates (like calendar spreads)

- It involves an underlying position and two or more option positions

- It involves more than four option positions

- It involves an awkward option leg ratio

- One or more legs need to be determined (such as for delta balancing)

- The positions will likely be closed or rolled long before expiration

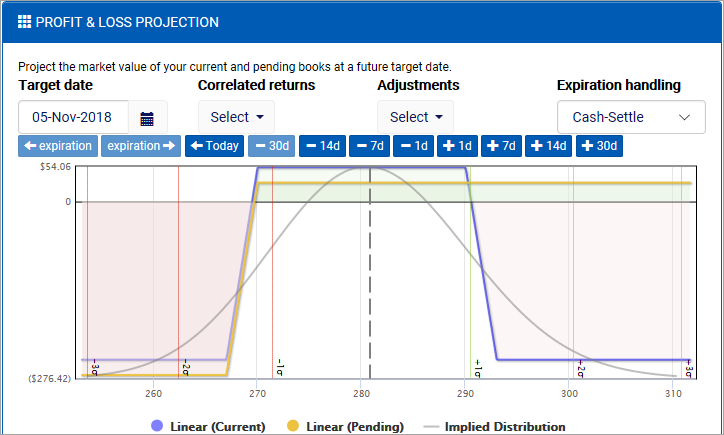

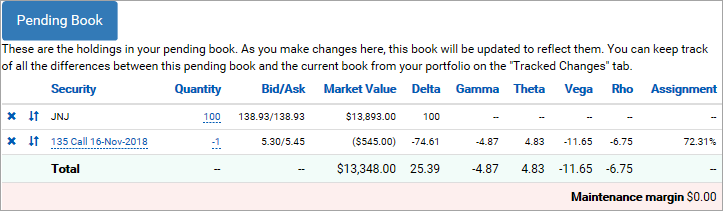

Book manager

The options book manager offers a powerful set of features designed to help investors manage option strategies of all shapes and sizes. Most of these features will be discussed later in the adjustment stage. In the meantime, we will focus on how the book manager can be an invaluable tool for crafting entry plans when the positions to construct meet one or more of the requirements above.

The book manager offers a completely flexible canvas for planning option holdings. New trade ideas may be sent here from the trade analyzer or charts. Trade plans may be tweaked by adjusting quantities or rolling expirations and strikes until an ideal payoff is discovered. There are also features to identify a single leg adjustment to meet the target trade or portfolio goals, such as delta-neutral balancing.

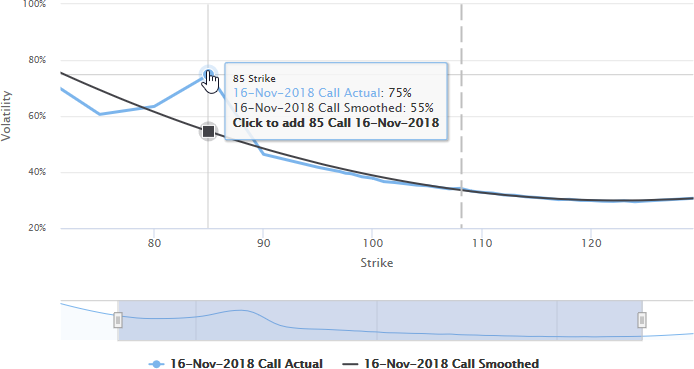

Charts

Quantcha offers a flexible charting package that enables investors to plot Greeks and other option metrics against each other. This makes it easier to identify the specific positions that may be preferred when expressing views around volatility or Greeks. As different options are identified, they may be aggregated into a selection of positions to send to the book manager for refinement and trading.