Developing a view with Quantcha

Investors developing a view require a lot of supporting research. The view is the underlying opinion that the rest of the investment will build on and around. While it is recommended that you gather research from a variety of types and sources, Quantcha offers a solid foundation for much of the data and insights you need to validate a view.

Stock screener

Quantcha’s options-focused stock screener provides a great starting point for the inception of investment ideas. It enables you to screen all optionable stocks for key properties, upcoming events, and proprietary option metrics. See Screeners to learn more.

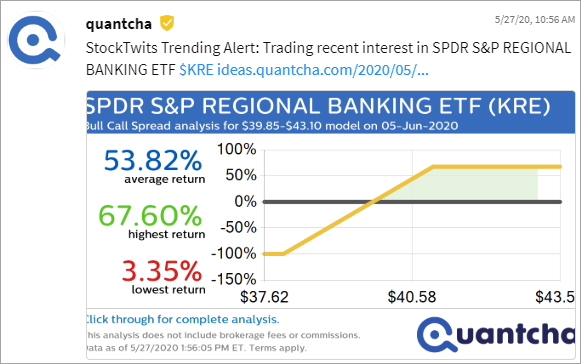

Trade ideas service

Quantcha provides a free trade idea service at https://ideas.quantcha.com. This service scans the market for interesting investment setups based on current market data. Scans include stocks at 52-week highs and lows, those with big moves on the day, those with big changes in StockTwits sentiment, and so on. You can also subscribe to these events by following the service at https://twitter.com/quantchaideas or https://stocktwits.com/quantcha. While this service produces specific trade ideas, they can just as easily be used as a channel for discovering interesting market developments based on the underlying theses.

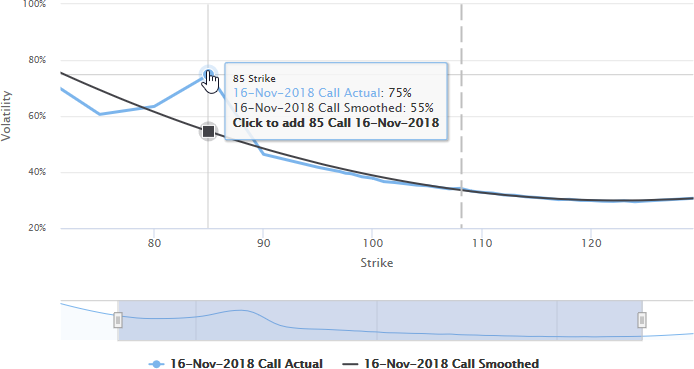

Flexible charting

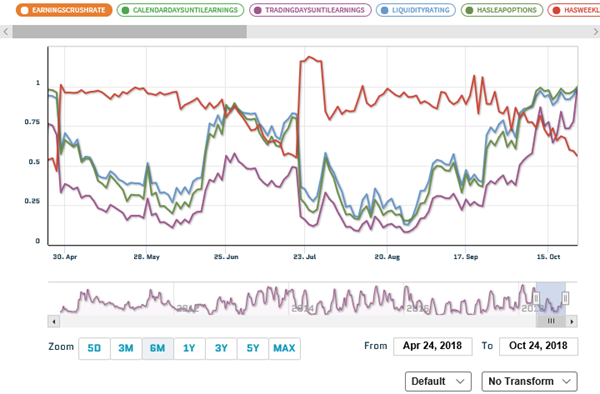

Quantcha provides the standard support for charting stock prices with the typical array of indicators. However, where things get really interesting is around charting support for Greeks and other option metrics. Investors can easily chart implied volatility against strike, theta against delta, and more. These visualizations help support a view of mispriced volatility anywhere along the surface.

Data & API

Investors looking to implement custom scanners or analytics tools can take advantage of just about anything in the Quantcha platform via data & APIs. See the Data & API page for more information.

More Quantcha features to support developing a view

Quantcha provides a variety of features that can help you develop your opinion on a stock or the overall market.

- Quantcha Alerts can be configured to raise notifications when market conditions change. While this service will be covered in more depth during the Monitor stage topic, its features are also relevant during the Develop stage. For example, you can set an alert for a stock to reach a threshold or when it approaches a milestone, such as earnings.

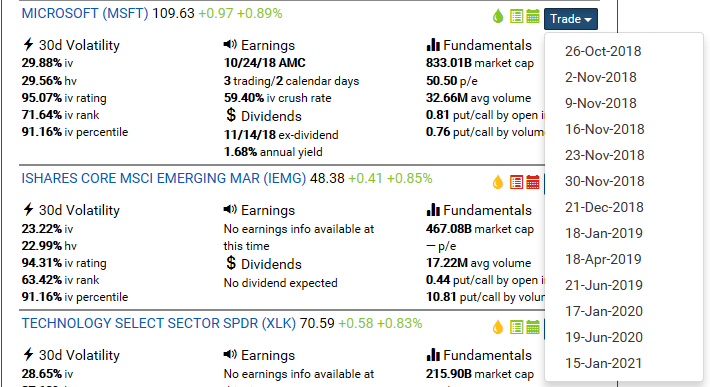

- The Watchlist enables you to keep tabs on stocks and specific trade ideas.

- The Stock Overview offers the ability to scope into the options data at each expiration. This makes it easier to understand analytics like put/call ratios, forward prices, and option breakevens at each term.