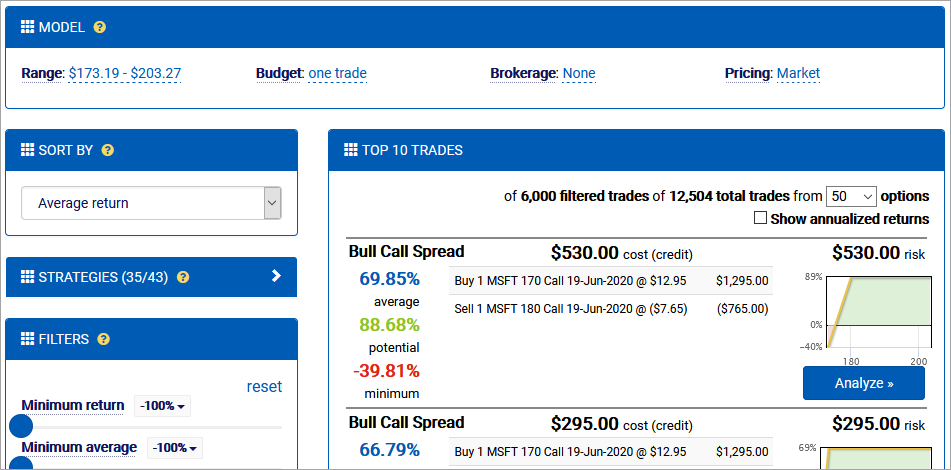

Suppose you’ve worked through your view and now have a high level of confidence in the expected price range for a target stock at a date in the future. You’d like to find the optimal way to trade it using options, but it’s not clear exactly which combination of legs will achieve the risk/return you’re looking for. Quantcha’s options search engine is exactly what you need.

Quantcha’s options search engine enables investors to find the optimal options trade to express a view on an underlying using a time horizon and price target. In this course, we’ll dive into its inner workings so that you can learn how to make the most of it. You’ll get plenty of hands-on experience to learn about tweaking your input model, filtering across a variety of properties, and reading into the trade analysis to fully understand trades before you place them.