What is the options search engine?

Suppose you have a directional view for a stock. More specifically, let’s say you expect stock XYZ to rise and eventually trade in the 100-110 range in the next eight weeks. You’re convinced that the market will play out as you predict, and you’d like to reap the benefits.

Let’s review some of your options:

- You could buy stock, but that probably wouldn’t yield the kinds of returns you could get with the perfect options trade.

- You could buy a call, but which one? Or what about selling a put? Both have their merits, and it wouldn’t take long to hack out a spreadsheet to compare the prospective returns of each strike.

- Then again, it’s hard to argue with the leverage afforded by a spread. A tailored bull call or put spread can produce outsized returns if placed correctly for an accurate view. This would be harder to model since each option could be paired with so many others.

- And if you have absolute confidence in the view range, nothing can beat a range-bound trade like a condor or butterfly. Again, the extra legs create even more trades to calculate.

So what should you do? The answer: it depends.

It depends on where the stock is trading now. It depends on the implied volatility surface. It depends on your trade budget and risk tolerance. It depends on the return you’d need to justify the risk for any given trade. It even depends on seemingly minor details, such as the size of the bid/ask spread for any given option, as well as so many other details.

When a similar information problem came up in the early days of the internet, several innovative companies stepped forward with a solution: the search engine. They knew it wasn’t feasible for anyone to take on all the manual work of analyzing and tracking the many potential hits for document queries, so they solved it with artificial intelligence. Why not do the same for options trades?

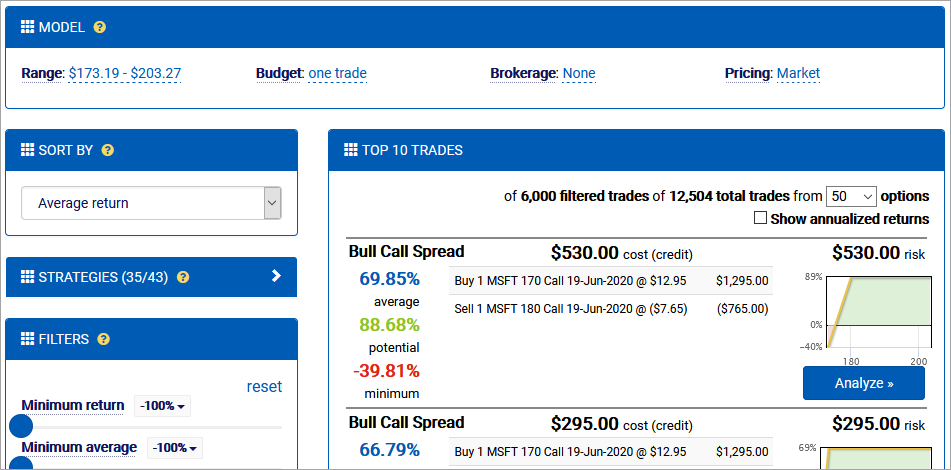

Quantcha’s options search engine is a powerful tool designed to help you find the optimal options trade for your underlying view. It provides a set of features for instantly analyzing tens of thousands of prospective trades in order to find the best ones to express your view. It does all the legwork for you so that you can focus on tweaking your model and filtering down to the trades that will help you meet your goals.