Developing an investment

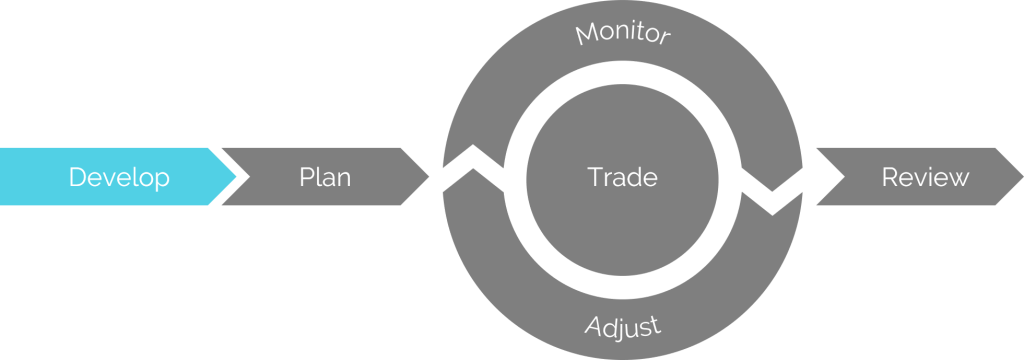

The first stage of InvestOps focuses on developing the investment idea. This is where an investor establishes the view that they want to express. These views can be influenced by virtually anything, and this is reflected by the representation of a virtually unlimited number of tools and services available in the market.

Stage input

As the first stage in the InvestOps process, developing a view has no prerequisites. The idea may come from any source, and it may or may not be related to your existing positions or other active investments.

Industry support is broad and deep

There are innumerable products available to help investors develop an investment view. The most straightforward are investment advisories as they usually just sell their already-developed views along with underlying research. There are also plenty of charting, scanning, and watchlist services that look for opportunities based on technical, sentiment, or other indicators.

These views can also arise from independent research. An investor may have a hunch about a given stock, so they pull up some charts and read the latest news.

It doesn’t really matter where the original idea for the view came from or how it’s validated. For the purposes of this course, we will assume that the idea is developed into an actionable view using the investor’s preferred practices. If that opinion reaches maturity, then it proceeds to the next stage, which is about planning the investment.

Developing a view vs. planning a trade

This raises a very important distinction between the development and planning stages. Development does not involve consideration of a trade strategy. It is purely about determining an investor’s opinion, which should be as precise as feasible. The planning stage is responsible for accepting a fully-formed view and producing a trade entry plan. These two stages should be managed independently of each other.

A sample scenario

Suppose you’re researching a stock and have decided that it should be trading over $100 for the foreseeable future. You’ve decided that this investment view is something you want to pursue and are ready to move to the planning stage to build a trade plan. You look at the quotes and realize that the stock is already trading at $105. However, you’ve done all the research and really love the company, so you’re thinking about buying the stock anyway.

Should you?

This is a tough question, and one that every investor needs to answer for themselves. However, you probably shouldn’t move ahead with the investment based on your established view. It’s completely fine to revisit your view to see if you can express it with more precision that would help justify the investment. Just remember that the whole purpose of developing your view in the first place was to remove the decision pressure for placing a trade that didn’t meet the parameters you put in place. Ignoring that because you want to trade won’t serve you well in the long run.

View considerations

An investor’s opinion may be price-centric, which is fine. Believing a stock should be trading above $100 is an actionable view. However, the more precise your view is, the better prepared you will be to identify an optimized trade plan in the next stage. If you trade options, factors like the time horizon become very important. You also need to consider changes in volatility, interest rates, and more.

When possible, also consider weighting different outcomes for a view. For example, if a stock is about to announce earnings, consider establishing the relative likelihoods of major cases. Planning for a 35% chance of a 7%+ drop against a 65% chance of a 4%+ rise can drastically improve your prospects for finding trades with outsized returns in the next stage.

Stage output

The output of this stage is a fully formed investment opinion. It should include everything an investor needs to optimize a trade entry plan, such as target prices, expected volatility, time horizon, etc. It’s also a good practice to include rationale for the view, such as expected news, projected earnings, and anything else that may be necessary for reevaluating the investment in later stages.

While there is no strict requirement, it is highly recommended that you write down and date your view. Notetaking software like OneNote can be an effective way to track a variety of investment ideas, including those that are not acted on.

View Development Worksheet

Looking for a worksheet to help you develop your view? Check out our free view development worksheet in the next topic.