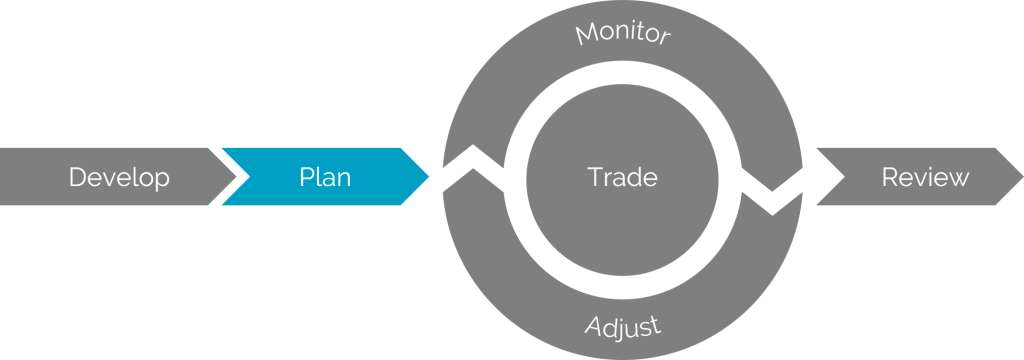

Planning an investment

The second stage of InvestOps focuses on optimizing the investment idea. This is where an investor determines the most effective way to express their view.

Stage input

The first input for this stage is the complete view developed in the previous stage. If this stage can’t produce a feasible entry plan for the investment, then the investment should be rejected or returned to the previous stage for retooling.

This stage also requires market data relevant to the type of investment under consideration. If it’s a directional stock play, then stock fundamentals, quotes, and options are important inputs.

The final input is an accounting of the investor’s existing positions. Sometimes the existing holdings may not play a role in planning a new investment, but they often do as portfolios grow.

Entry plan considerations

As an investor optimizes the trade (or trades) they’re planning to execute to express their view, there are some key questions to answer.

Are there alternative entry plans?

An investor restricted to buying stock doesn’t have much flexibility. However, if you can trade options, there may be a virtually unlimited number of approaches available. Trading a bullish view could involve buying a call, or it could involve selling a put. Depending on your view, these alternatives may offer a more optimized solution than a standard stock purchase.

How are you protecting your downside?

Downside protection plans often evolve over the InvestOps journey. However, it’s important to understand what considerations, if any, will be factored in as part of the trade entry.

Some common downside protection plans include:

- Stop orders to limit losses

- Use of options to limit losses (like buying a call instead of stock)

- Use of options to hedge losses (like buying a put to hedge a stock purchase)

- Use of correlated positions to hedge losses (like pair trading two correlated stocks)

- No downside protection on purpose

What is your time horizon?

Including a timeframe in an investment view is incredibly helpful when it comes to planning the ideal entry. For example, an earnings trade may be ideally expressed using weekly options, especially if the investor has no interest in the stock beyond the impact of the earnings announcement.

How does this investment impact your overall portfolio?

Most investors prefer to balance their portfolios such that they avoid too much exposure from a single source. This risk could come from allocating too much of their portfolio toward a given stock, allowing a book’s delta to exceed a certain range, leaning too much toward or away from a given investment theme, and so on. As a result, the current investment under consideration may end up not being a fit, may need to be scaled differently, or may require adjustments to other positions to achieve a target portfolio.

Is it worth it?

And finally, the key question every entry planning stage must clear: is the expected return on this investment worth the risk? This will involve quantifying both the risk and expected return, which may require specialized tools. Be sure to understand the risks, especially if working with leveraged instruments like options or naked positions.

Adjusting the plan

In addition to crafting an entry plan, investors should consider the adjustments that will need to be made down the road.

What does a successful exit look like?

A common mistake is to hold on to investments well after they’ve achieved their goals. It’s a good practice to define what a successful exit looks like during the planning stage to have a point of reference when reevaluating the plan later. If it’s as simple as “close when the stock reaches $110”, then consider placing a “good until cancelled” order at that price as soon as you open the original position. If using options, spreads and other hedges can help enforce an exit plan on a schedule.

How will you know if the investment has failed?

The best views are predicated on specific and measurable expectations. If one or more of those expectations changes over time, then it may be time to pull out of the investment. It’s important to understand what those criteria are and how they will be tracked.

When will you need to adjust the investment?

It’s very common for views to change over time, and it doesn’t always mean the investment needs an exit. Depending on the opinions underlying the original thesis, an investment may need to be adjusted or revised as expectations change. Like the success and failure scenarios, consider how positions may be adjusted to accommodate new information. For example, “scale up 100% if the stock reaches $105 by June 30”.

Some investment strategies may have built-in adjustment requirements. Consider investors who roll covered calls. They may plan to sell monthly options and expect to roll forward once those options are within a week of expiration. In addition, they may also need to roll their calls early if they’re at risk of being called away due to an upcoming dividend.

Stage output

The output of this stage is a trading plan. At a minimum, the plan should include the detailed positions to be put on (or taken off) to optimally express the view. It is also recommended that the plan include criteria for success, failure, and adjustment where applicable.

Trade Plan

Looking for a plan template to help you get started? Check out our free trade plan in the next topic.