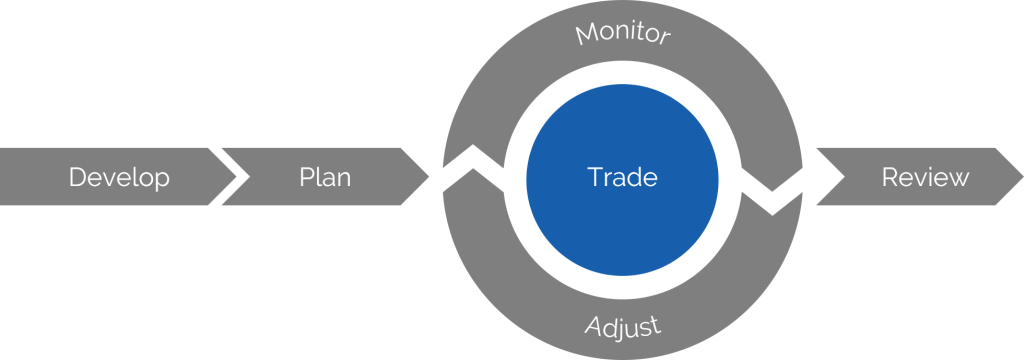

Scenario: Trade

Wednesday, July 1 @ 3:39 PM

With the trade plan in hand, Mark is ready to start placing orders. If this were a simple stock purchase, he’d just place a limit order and walk it in. However, the trade plan calls for a call spread, which may require additional attention.

Executing the trades

It’s been a few hours since Mark finalized the trade plan, and the underlying stock has continued to edge upward. As a result, this has impacted option prices and lowered the profit potential slightly due to the reduced risk. The trade plan assumed he could enter the spread at a net debit of $2.80, but the market pricing of the trade currently has it at $3.00.

He reviews the option chain and observes that the bid/ask spread is nearly $0.40 wide for each option. However, his experience indicates that this is probably a trade he can get filled for a better price, so he sets up a limit order for the $2.60 midpoint and waits to see how the market reacts.

As he waits for a bite on the order, Mark investigates the possibility of legging into the trade. By reviewing the market depth, he determines that there is some interest, although it’s not heavily traded. He does notice the last traded prices update a few times for his target options, so there is some slack in the spread.

Unfortunately, it’s approaching the close of the market day. Mark decides that it’s not worth legging into the spread because he doesn’t want to risk getting stuck overnight with only the long or short leg filled. Instead, he gradually walks the limit order up to the maximum $2.80 bid. Fortunately, it’s filled in the last minute of trading, and he is now officially ready to move on to the next stage.