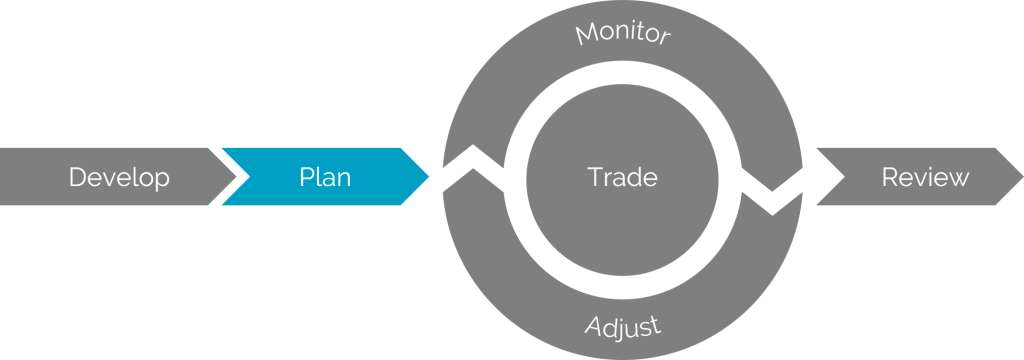

Scenario: Plan

Wednesday, July 1 @ 11:12 AM

Mark decides to take a night to sleep on his new view. Investing involves real risks, and it’s important not to rush into an opportunity, even when it seems like a sure thing. He watches the stock like a hawk all morning, and it takes everything he has to not just start buying shares.

It’s been a day since he signed off on the view, and he still feels complete confidence in the opinion. Based on his InvestOps training, he knows that the next step is to create a trade plan to express the view. Once again, this isn’t something he’s ever done in a structured way, so he decides to start with the Trade Plan template.

Creating a trade plan

One of the first things Mark likes to do before planning a trade is to scope a trade budget. After reviewing his balances and existing positions, he determines that the most he’s willing to risk losing on this trade is $300. Unfortunately, the stock is trading around $205, and he’s not sure he wants to enter a trade for a single share. He could potentially buy a few shares and manage the downside risk to $300 with stop orders, but that would still be relatively capital-intensive.

Instead, he decides to see what the options market has to offer. He chooses to avoid the options expiring a few days later this week, and doesn’t want to go too far out due to the earnings announcement in three weeks. Looking at the put chain for next week shows some interesting opportunities, but the bid/ask spreads are pretty wide. However, the call chain has tighter spreads near the money, so he models a spread using the 202.50 and 207.50 calls that has an attractive risk/reward ratio. Even with market pricing, he could still enter for $280 and have a potential profit of $220 if the view turns out to be correct.

Before settling on the trade, Mark performs a quick analysis of how it will affect his portfolio. This will be a small “flyer trade” and won’t change his portfolio metrics too much. The size won’t noticeably change his allocation ratios or portfolio Greeks, so he doesn’t see a need to adjust anything else as part of the entry plan.

Planning the exits

If he decides to move forward with this trade, Mark will need to know when it’s time to exit. Fortunately, these decisions are sometimes easier when trading options. In this case, the best possible exit would be if the stock is trading comfortably above the higher strike at expiration. Then both options would be exercised, resulting in a cash settlement for full profit. Even if the higher strike isn’t reached, there’s still an opportunity for profit. Based on the trade analysis, he expects around $150 in profit if the view holds up.

On the other hand, the stock might not move as expected. Fortunately, the downside is inherently hedged by the trade itself. Since the risk is defined and acceptable, he decides that he’ll ride out the trade until expiration, regardless of how the stock is moving.

Planning for change

A trade plan is developed at a singular point in time based on the best information available at the time. As the facts change, so too may the view or trade requirements. While it’s impossible to foresee every possible outcome, there are some scenarios that are easy to plan for. When dealing with directional trades, this could be a sharp move for or against the investor.

Mark decides that one scenario the view hints at is the expectation that the underlying could rise sharply as other investors start to pay attention to the undervalued stock leading into earnings. If this happens, then the trade may realize most of the profit potential early on. If so, there’s still room to roll the strikes up and out to the following week to capitalize on more profit before earnings hits.

Mark’s trade plan

By the time Mark is done planning the entry, exists, and potential adjustments, his plan looks like this one.