Scenario: Review

Friday, July 10 @ 3:43 PM

Mark eagerly awaits the market close coming in a few minutes. The stock underlying his options trade is now trading at 217.15, well above his call strikes of 202.50 and 207.50. While he’s happy to see the view play out stronger than expected, he is becoming nervous that the stock may have moved up too far, too fast.

At this point there’s nothing left to do but to wait for the final minutes to tick off. The trade is on track to produce its maximum return, which nets a $220 profit on a $280 investment for a 79% gain. He also doesn’t feel any pressure about when to get out. If he held the stock, he’d constantly second guess his decisions. With this options trade there is a natural termination.

As he monitors the bid/ask spreads of his option legs, Mark breathes a sigh of relief that the positions will cancel each other out at expiration. As deep in-the-money calls on a stock with low option liquidity, he’d lose a substantial portion of his profits if he were forced to close them through orders. He admits to himself that he didn’t pay enough attention to this risk when planning the trade.

Saturday, July 11 @ 2:11 PM

Mark sleeps well Friday night. His investment view was spot-on. He expressed it effectively with a thoughtful trade plan. He executed the plan with discipline. However, he knows the work is not done.

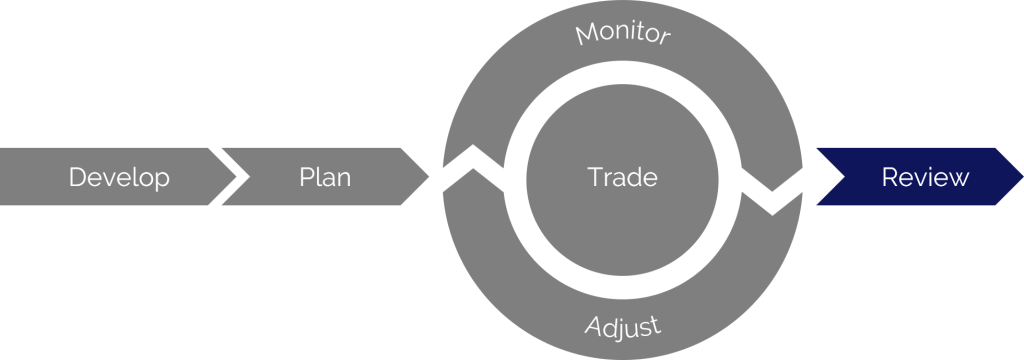

Despite everything that went right in this scenario, there were still lessons learned. Mark wants to improve his craft, and he’s willing to put the work in. He knows that this final InvestOps stage is important for growth, but it’s not something he’s ever approached with structure.

To get started, he downloads the Postmortem Review template. It includes fields he can use to guide his self-analysis through the process and results of the completed investment. As he works through the review, he recalls notes and experiences along the way.

Mark isn’t reviewing his performance to pat himself on the back for great returns. Instead, he’s honestly assessing his research, inferences, planning, and execution so that he will continue to improve over time. It’s a good practice to draft the analyses and notes as though you were giving someone else guidance.

Mark’s postmortem review

By the time Mark is done reviewing his investment, his postmortem looks something like this one.