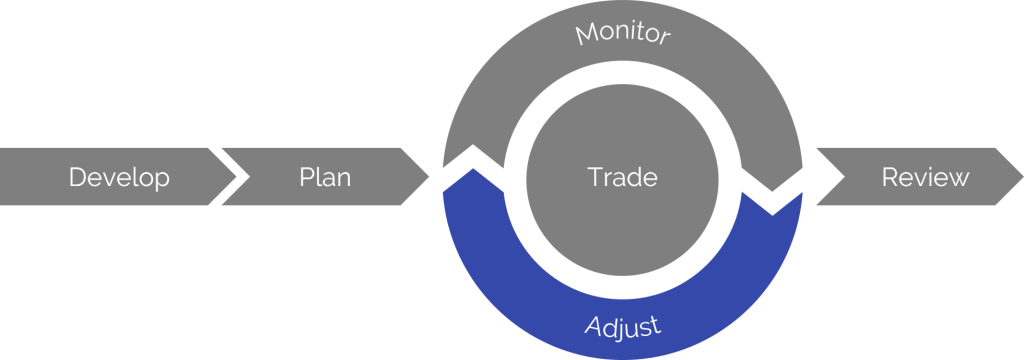

Scenario: Adjust

Wednesday, July 8 @ 12:34 PM

Mark has been monitoring his trade for a week, and just received an alert about the pricing of his trade. He checked in on his portfolio to find that the underlying is trading at 210.29. This puts both options, long at 202.50 and short at 207.50, in the money. It also gives him an opportunity to consider adjusting the strategy.

Weighing the options

Option 1: Close the trade

If he closes the investment right now, he will net $150, which was the expected profit of the trade. This also removes future risk and reward uncertainty.

Option 2: Hold the trade

If he holds the position and the stock stays flat or rises by the close on Friday, he’ll net the maximum profit of $220. However, if the underlying drops, he’ll likely lose value with the possibility of a net loss on the trade.

Option 3: Roll the trade

If he replaces the current trade with a comparable trade using next week’s options and higher strikes, then there’s an opportunity to capture more profit. At the same time, he would also run the risk of giving his current profits back if that trade move against him.

The adjustment decision

Mark reviews his view. While the news of the stock rising is welcome, it doesn’t materially change his opinion. He anticipated this rise, and the movement is validation. He also hasn’t seen any other developments that would impact the original view, so he keeps it as-is.

Next, he reviews the trade plan. The success and failure exits are clearly defined: hold until expiration. Even though he’s proud to be showing some nice profit so far, he doesn’t feel a need to change the trade plan.

The trade plan also included an adjustment strategy for the scenario where the stock surged. In this case, the stock is up enough to put both strikes in the money, but not necessarily what he had in mind for a “surge”. He now regrets not being more explicit about the size or timing of a surge. For example, he wishes he had written something like “If XYZ is trading above 210 by EOD July 6, then…”. He makes a mental note to include this lesson in the postmortem.

Based on his review of the trade plan, Mark decides that there is no need to adjust the strategy. He will return to monitoring the investment and reconsider adjustment if there are additional developments.