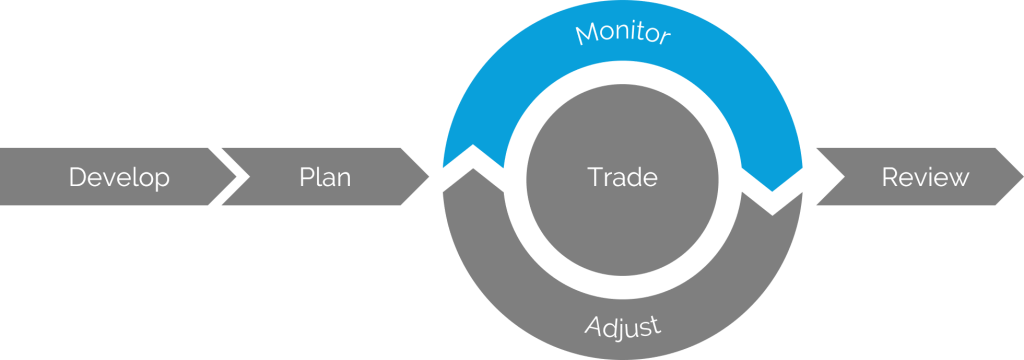

Scenario: Monitor

Wednesday, July 1 @ 4:15 PM

After his entry order fills, Mark now sees the new positions in his brokerage account. He plans to monitor the trade by checking in on this page every day, but he secretly knows he’ll probably bring it up a few times per hour while the market is open.

He also creates a news alert for the underlying stock. Even though the plan is to hold the trade through expiration, it’s possible something major might come up, and he’d like to be among the first to know.

Finally, Mark decides to try out a portfolio monitoring service. The original analysis suggested that the trade should produce an expected profit of $150 if his view is correct. For the sake of curiosity, he creates an alert to let him know when he can close the trade for $430, which would net a $150 profit. He doesn’t plan to actually close the trade at that time, but would like to receive a notification if and when the opportunity comes up.

Wednesday, July 8 @ 12:25 PM

It’s been a week since Mark started monitoring his investment. The underlying has been a little volatile, but overall it’s moved in his direction. During lunch he receives an email from the alert service to let him know that the market is offering $430 for his trade.

He checks in on his portfolio and notices that the stock has moved up nicely on the day, putting both of his options in the money. The trade adjustment plan indicated that if the stock moved up sharply that the trade could be rolled up and out for more profit.

Should he adjust? And, if so, how?