Exercise: Experimenting with prospective adjustments

Option investors often find themselves planning changes to one or more positions in a target book. Given the vast number of options available across all terms, it can be really challenging to manually evaluate how changes will affect their overall position. This is one place where the book manager really shines.

So far, this course has focused on reviewing a TSLA covered call position. As this strategy was already open when the course began, it’s part of your open investment. Whether you manually edit your Paper portfolio from the portfolio tracker, import positions from a file, or pull in positions through a linked brokerage, the positions you currently have open are referred to as your Current book.

Current vs. pending books

The book manager is designed to help you figure out how to adjust your holdings to reflect your changing market views. It starts off with your current book and provides a sandbox for you to experiment with the changes you’re thinking about making. As you make changes by adding, removing, or updating specific positions, those pending changes are tracked separately as your Pending book.

As mentioned earlier, your pending book is the same as your current book by default. That’s because there are no changes yet applied. It also means that the P&L will only show your current book in blue.

Select the Next Expiration button to move the target date to the next (only) expiration in the book.

Understanding the pending book

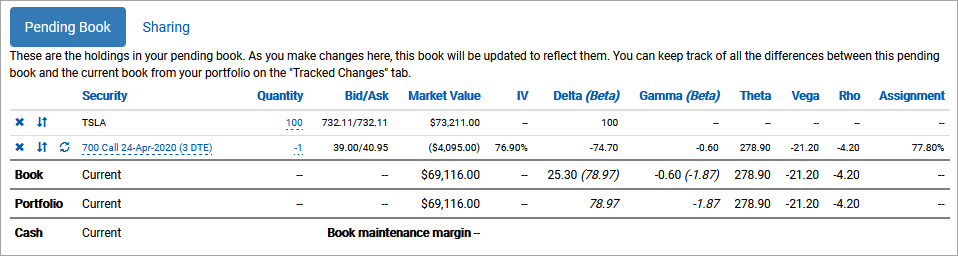

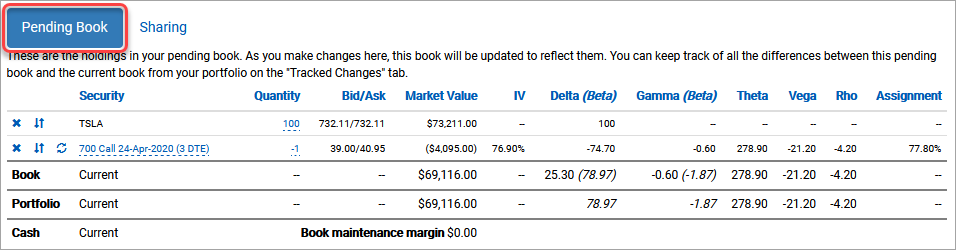

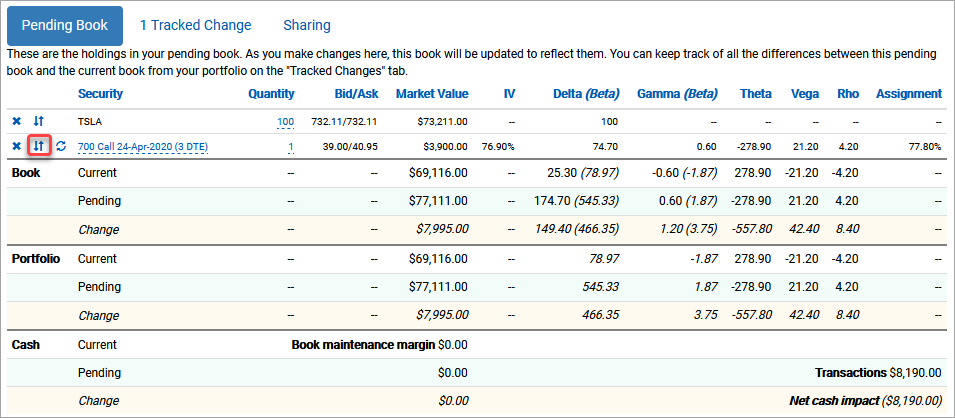

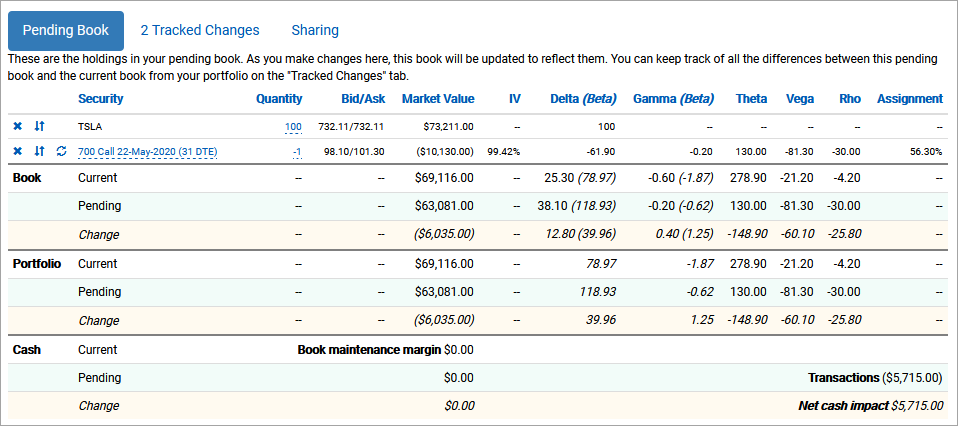

The positions of your pending book are available for review further down the page.

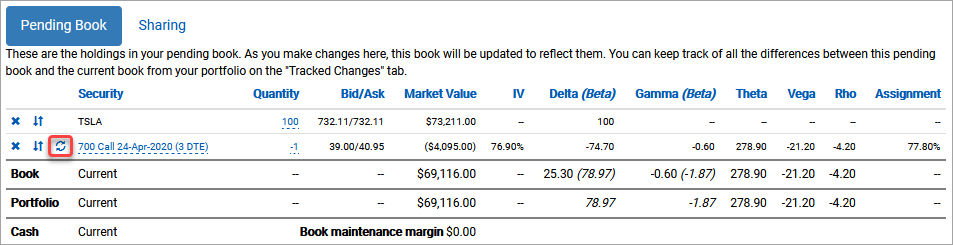

Scroll down to the Pending book tab.

The pending book (which is the same as the current book) contains 100 shares of stock and a short call expiring in two days. You can also review the bid/ask spreads of each position, as well as the total market value of each position. Short positions will have a negative value representing the cost to close based on the current asking price. There are also columns for IV, Greeks, and assignment risk.

Closing positions

Let’s experiment with our first change.

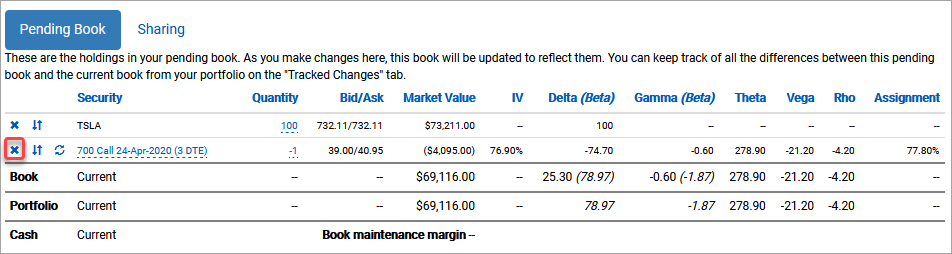

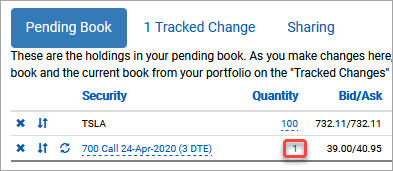

Click the Close position button next to the short call position.

Closing the short leg position simulates the transaction to close. It doesn’t make any changes to your current book, but rather removes it from the pending book so that you can evaluate how that change would impact book properties and future returns. In this case, you are evaluating the original covered call vs. a long stock position (plus the cost of buying back the short call).

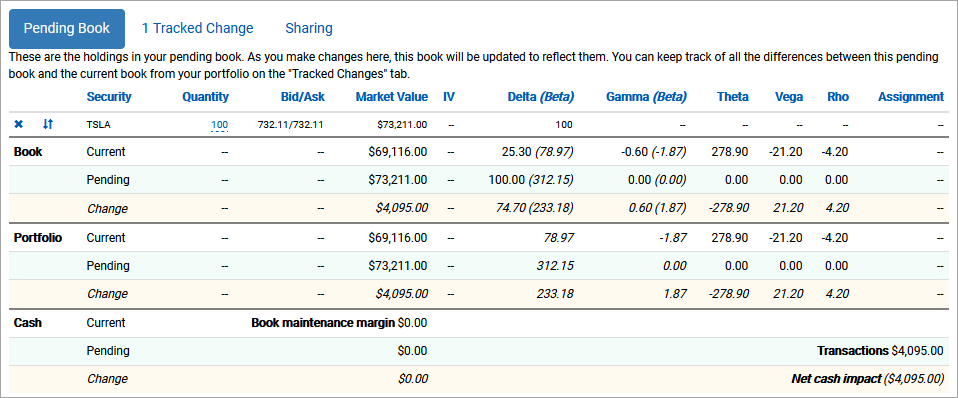

Several things just happened throughout the book manager, so let’s walk through them one by one.

First, notice that the short call position is no longer in the table. This resulted in changes to the properties of the overall book and portfolio.

The Book section of the table shows three rows.

- The Current row shows the properties of your current holdings. Nothing you do in the book manager will change these values.

- The Pending row shows the properties of your pending book. Any changes you make to the book will reflect here. Two fields (delta and gamma) also include beta-weighted numbers (when a correlation with SPY is available). These values help you understand the impact this book has on portfolio metrics relative to movement in the SPY ETF.

- The Change row is the difference between the current and pending books. It’s an easy way to gauge how changes you’re considering impact key properties, such as when you want to add a certain amount of delta or theta to your book.

Similar to the book section, the Portfolio section also shows three rows.

- The Current row shows the properties of your current portfolio (this and all other books).

- The Pending row shows the properties of your portfolio if you were to apply these changes. They only account for beta-weighted delta and gamma since those book-specific Greeks aren’t meaningful to the overall portfolio.

- The Change row is the difference between the current and pending portfolios.

The Change section also shows current, pending, and change values for the Book maintenance margin. These numbers are based on naked margin trading requirements. This means that net short puts will show short put margin and not cash-secured put margin. This section also includes the total cost of all transactions required to adjust the current book into the pending book, as well as the net cash impact. The net cash impact will balance out with the transaction cost unless there is a change in margin.

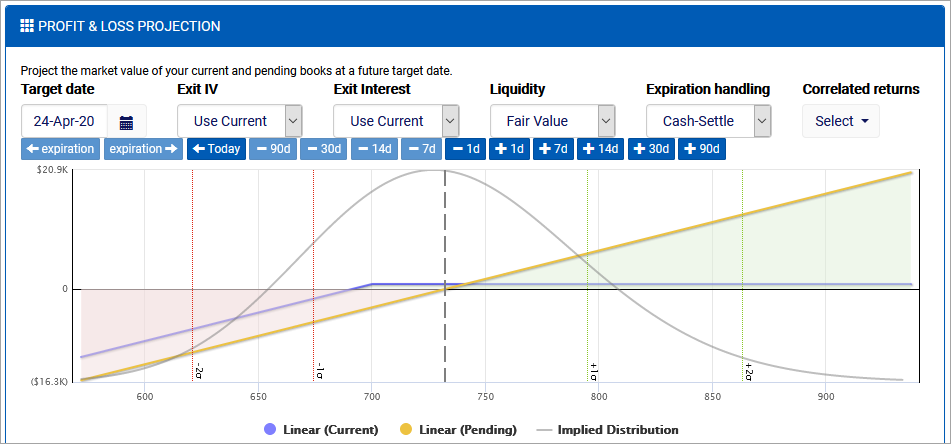

Scroll up to the Profit & Loss Projection.

The P&L now includes a second dataset in yellow that represents the pending book. This enables you to more easily visualize their relative expected returns to validate whether the results match your goals. You can use the same parameters and navigation to evaluate both books simultaneously.

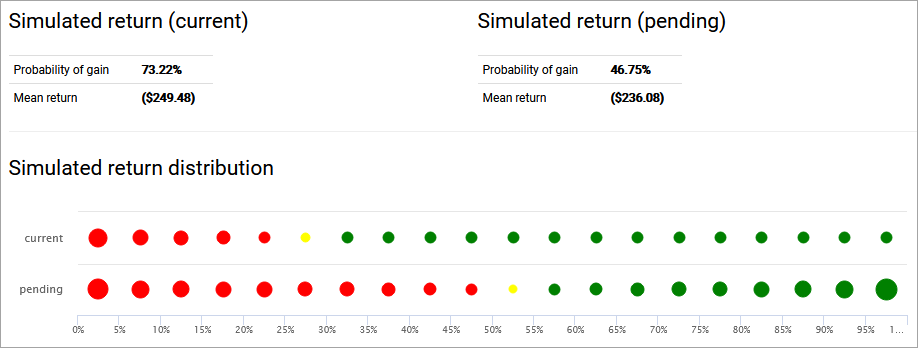

You can also review simulated returns for the current and pending books side-by-side. In this case, it’s clear that the current covered call book has a higher probability of profit, although the pending long stock book has the potential for greater returns.

Applying and resetting changes

You can make any kinds of changes you want to the pending book, even those that contradict each other. For example, if you were to add two separate spreads to the book that had offsetting legs, the book manager will keep track of the most efficient way to get from the current book to the pending book.

Return to the Pending book section.

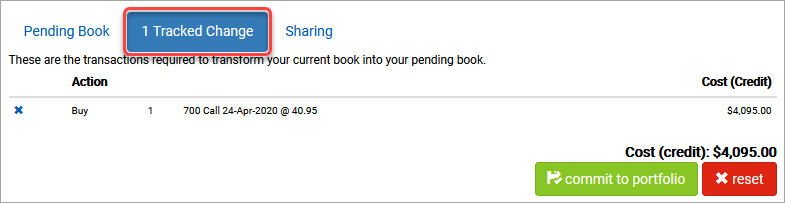

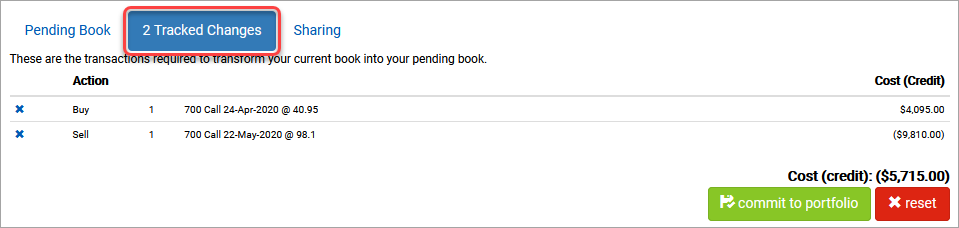

Select 1 Tracked Change.

The Tracked Changes section keeps track of the transactions you need to make to get from the current book to the pending book. If you are linked to a brokerage, there will be an option to send the positions to a trade ticket for easy order placement. Otherwise, you can add the positions to your paper portfolio (current book) by clicking commit to portfolio. You can also reset the pending book back to match the current book if you want to start from the original positions.

Click Reset to reset the tracked changes.

Return to the Pending Book tab.

Inverting positions

In addition to the button to close out a position, there is also a button to invert a position.

Click the Invert Position button for the short call position.

Manually editing quantities

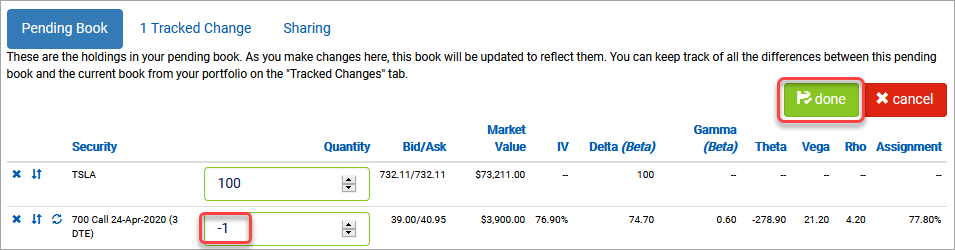

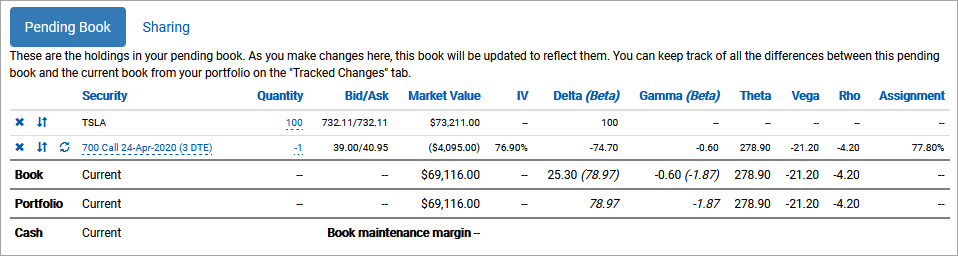

Inverting a position simply flips the sign on that position’s quantity. In this example, you went from being short one call to being long one call. You can also manually edit quantities in line.

Select the quantity of the long call position.

Update the call quantity to -1.

Click done to apply the change to the pending book.

Note that since those two changes (inverting and then manually setting the quantity to -1) offset each other, so the book manager recognizes that the pending book matches the current book. As a result, there are no changes to track or display.

Rolling positions

One of the most common needs for options books is to roll positions by replacing an option position with another, usually longer-dated, option of the same type. The book manager makes this really easy to experiment with.

Click the Roll Position button next to the short call.

Rolling by expiration

The book manager provides access to all available calls for you to select the one that best meets your goals. To make this easier, there are multiple filters so that you can easily zero in on the right one.

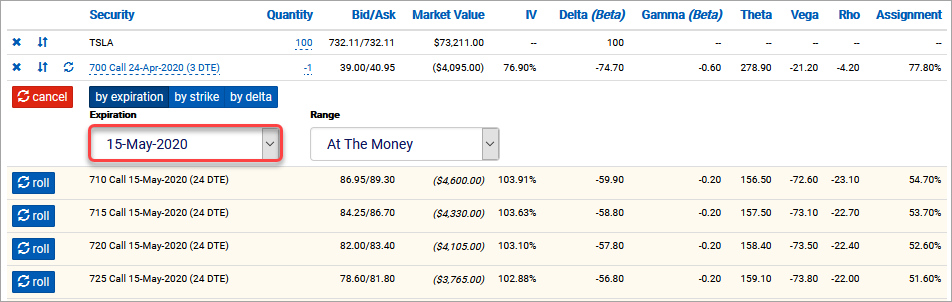

If you already know which week you want to roll to, then the expiration filter is ideal.

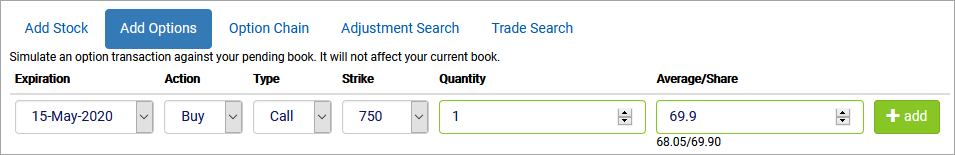

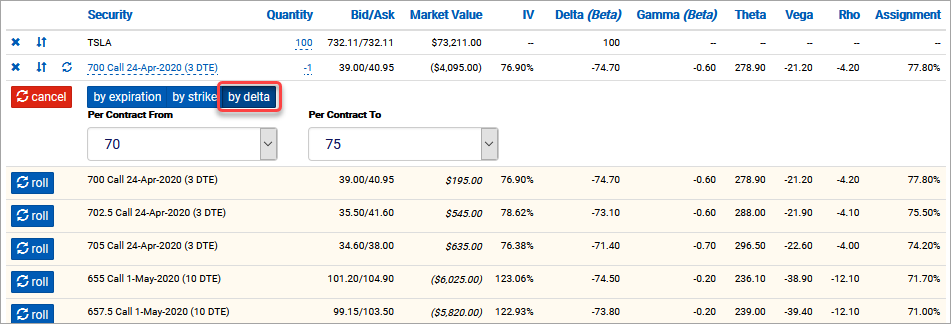

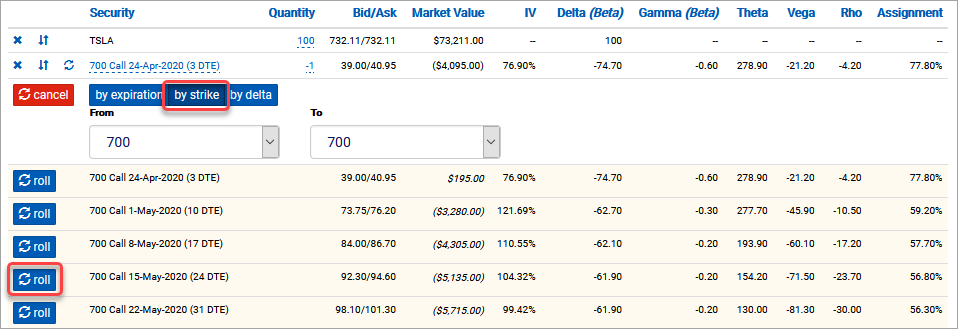

From the Expiration dropdown, select 15-May-2020. By default, the expiration tab displays options near the money. However, you can adjust the range of options displayed using that dropdown. Each prospective option includes data on how it will impact your book. The Market Value column displays the credit/cost of the roll transaction, which assumes buying at the asking price and selling at the bid (so you may be able to do better). For example, rolling to the 710 call would produce a net credit of $4,600. The other data is specific to that particular option based on the quantity. If you’re looking to roll into a position based on delta per contract, there is a filter for you. Select the by delta tab. The delta filter lets you filter on a per-contract basis to find the roll you’re looking for. The dropdowns allow you to filter based on 5-delta increments and default to the current position’s delta window. If you’re looking to roll to a specific strike, that tab provides the easiest way for you to evaluate options across expirations. Select the by strike tab. Select roll next to the 15-May-2020 option. Rolling to this option simulates the process of buying back the current option and selling the same quantity of the new one. The book manager also provides a convenient way to send the multileg transaction to a trade ticker (or commit it to your paper portfolio). Select the 2 Tracked Changes tab. There are several ways to add new positions to a pending book. One of the main ways of adding positions to a pending book is to send them to the book manager from the trade analyzer or charts (to be explored in a later topic). You can also add new stock or option positions to your pending book manually by using the tabs at the bottom of the book manager. They provide features such as adding stock, adding options, and selecting options to add from an option chain. These changes are all additive, so if you will add or subtract from any existing positions, if held. We will explore the Adjustment Search in a later topic.

Rolling by delta

Rolling by strike

Adding new positions