Exercise: Finding optimal balance trades with the adjustment search

Many investors manage their option books by setting a target range for Greeks, such as delta and gamma. By balancing certain Greeks, you can reduce risk from their relative underlying pricing parameters. A full discussion of the Greeks is beyond the scope of this topic, so this exercise will try to demonstrate the relevant features of the book manager at an introductory level.

This exercise picks up where the last one left off, but it uses a different scenario. You will use one of Quantcha’s option charts to locate an option that appears to have overpriced IV. You will then create a pending SPY book around selling that option. Finally, you will use the book manager’s adjustment search to locate a single-leg transaction that can help you balance your book’s delta and gamma.

Sending positions from an option chart

Let’s walk through the process of locating an overpriced option using one of the option charts.

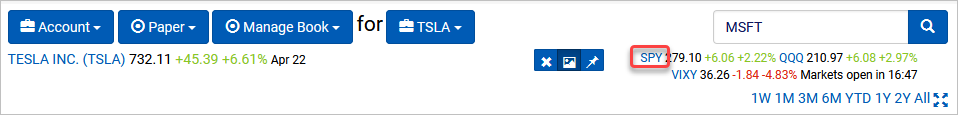

Select SPY from the market quotes from under the breadcrumb search.

From the SPY breadcrumb dropdown, select Charts.

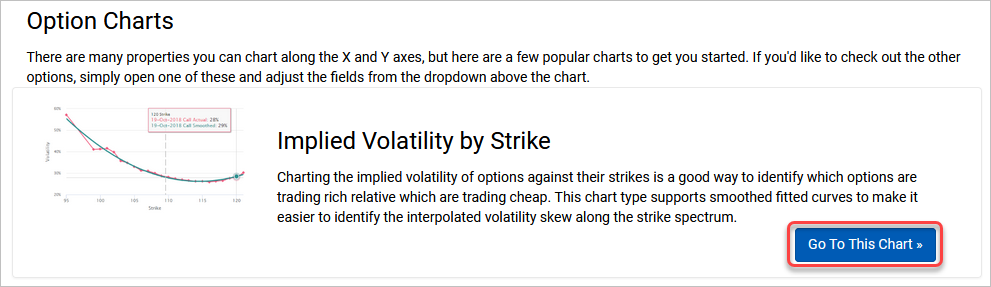

Quantcha’s option charting is very flexible, and you can update the axes on the fly to isolate the specific options you’re looking for. To help you get started, the chart landing page has some shortcuts to popular charts.

From the Implied Volatility by Strike section, select Go To This Chart.

This chart allows you to map the implied volatility skews against strikes at different terms. This can be really helpful if you want to analyze the skews at different terms for calls and/or puts. By default, the first series is displayed, but we’re not going to use it. Instead, we’re going to check out the puts expiring in a few weeks

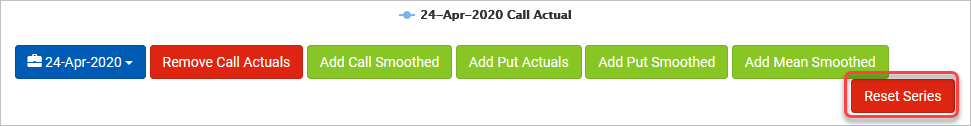

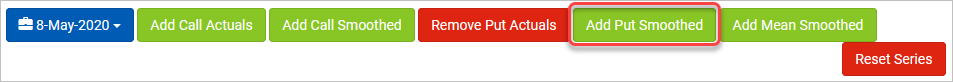

Select Reset Series to remove all series from the chart.

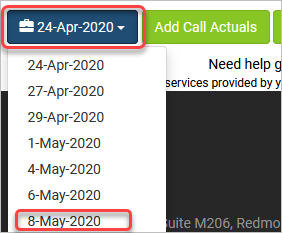

From the expirations dropdown, select 8-May-2020.

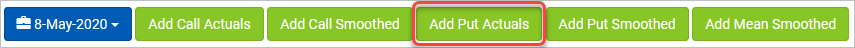

Select Add Put Actuals.

The actual implied volatilities for puts expiring on this date are displayed.

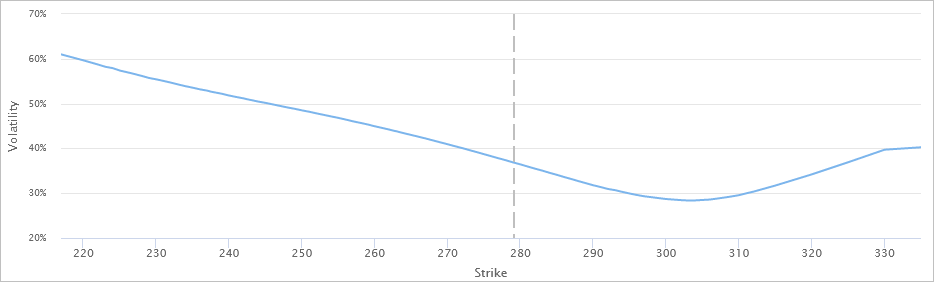

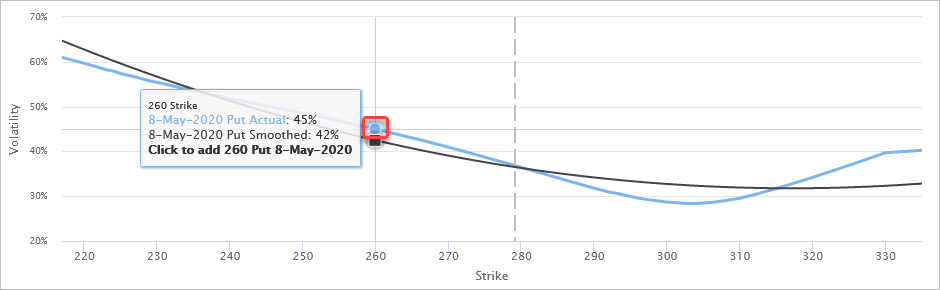

While you could probably eyeball which strikes are selling at a relatively higher premium, sometimes it’s easier to view the skew against a smoothed skew. The smoothed skew is simply a polynomial regression that interpolates the “fair” value of options based on the curve that best fits all current prices.

Select Add Put Smoothed.

While it might seem that the skews are solid lines, they’re actually distinct points at option strikes with interpolated lines between them. As you find interesting options, you can click their points to add them to a working chart book. This is a temporary place to experiment with different options that you can ultimately send over to the book manager when you’re ready to analyze in more depth.

Click the 260 put. It will be a distinct point on the blue line. If you click the point on the smoothed skew (black), it won’t do anything.

The 260 put is added to the working chart book at the bottom of the page. By default it is added with a long quantity of 1. However, since we have identified the option as being overpriced, the quantity should be negative to reflect a short position.

Click the Invert Quantity button next to the 260 put position.

We could spend more time in the charts to find other positions to sell for more potential income or to hedge. We could also look for relatively underpriced options that could be bought to hedge risk. However, for the purposes of this exercise we will send this position over to the book manager to balance.

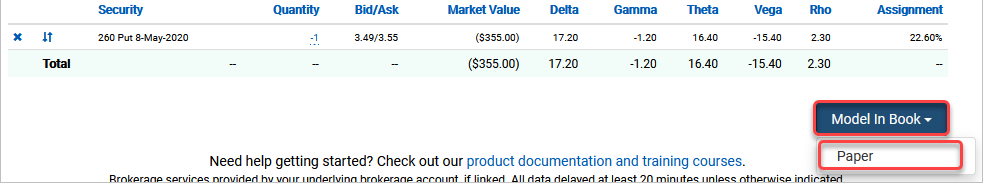

From the Model In Book dropdown, select Paper.

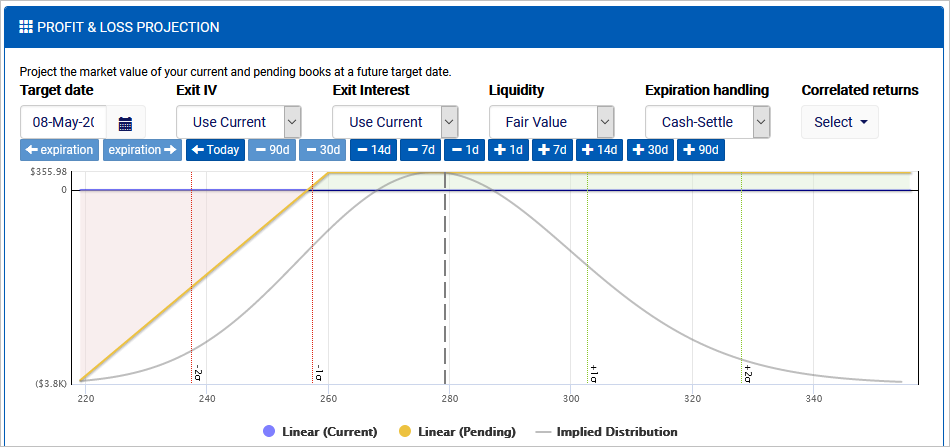

The book manager will open the new position as a pending book. Since your portfolio doesn’t have an existing position in SPY, there is no current book to show. The P&L looks about right for what we would expect for a short put position. However, it has a clear directional bias that we should address based on our initial view.

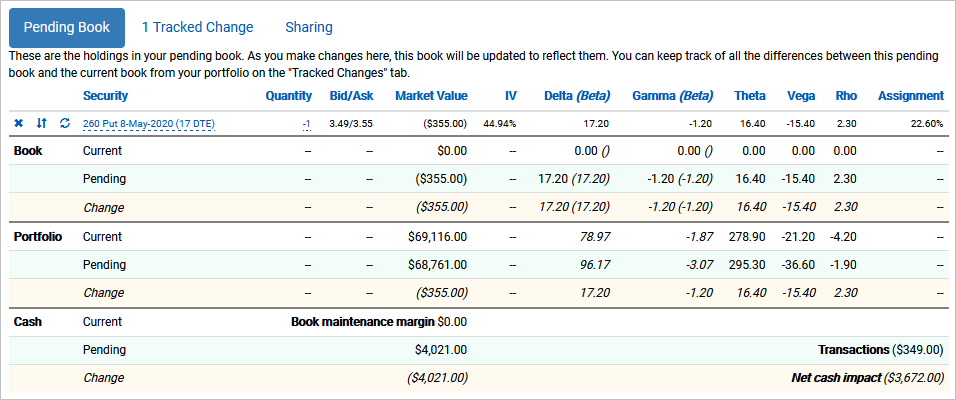

Scroll down to the Pending Book.

The pending book provides the details we need to understand net Greek positions. The key points to note are:

- Delta is higher than we’d like in this arbitrary scenario. For this exercise we will target a range of +/-5.

- Gamma looks fine within +/-5. However, whatever change we make to adjust for delta should keep gamma in range.

- Theta is positive, which means we gain value as time passes.

- Vega is negative, which means we gain value if IV decreases.

- Book maintenance margin is estimated at $4,021. This assumes that we have short put margin enabled (as opposed to requiring $26,000 to completely secure the short put with cash).

- Transactions will net $349, which means the net cash impact will require $3,672 (margin less transaction credit).

As mentioned earlier, the current trade has a bit of a bullish bias. Since we’re not trying to take a directional position, we can find a way to trade some of that upside benefit (in this case it’s a lack of risk) to improve our strategy elsewhere. The Adjustment Search is ideal for this. We can use it to find a sortable lit of single-leg trades that will balance our delta and gamma.

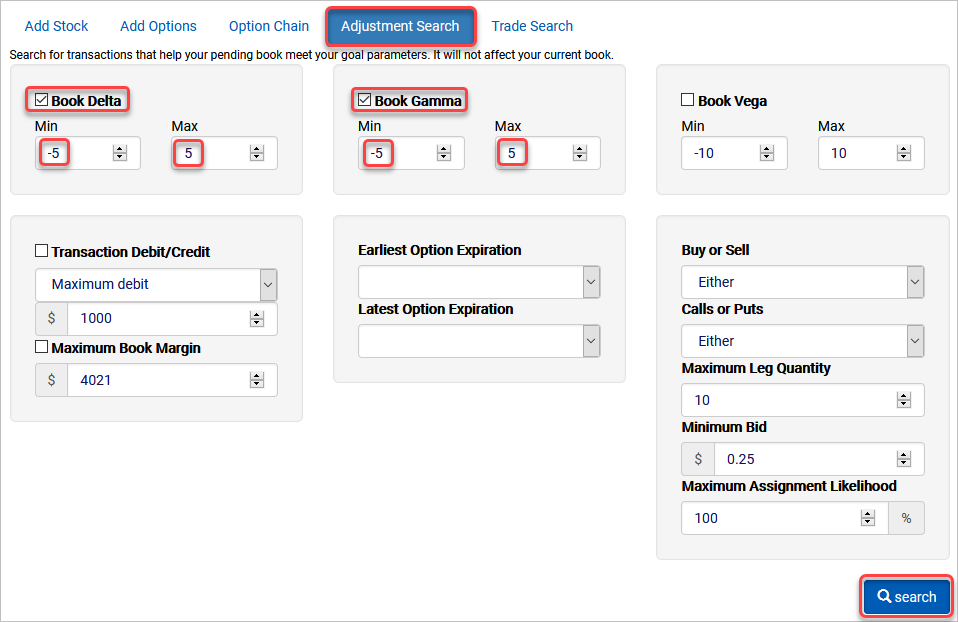

Select the Adjustment Search tab at the bottom of the page.

Select Book Delta and set a range of -5 to 5.

Select Book Gamma and set a range of -5 to 5.

Click Search to run the search.

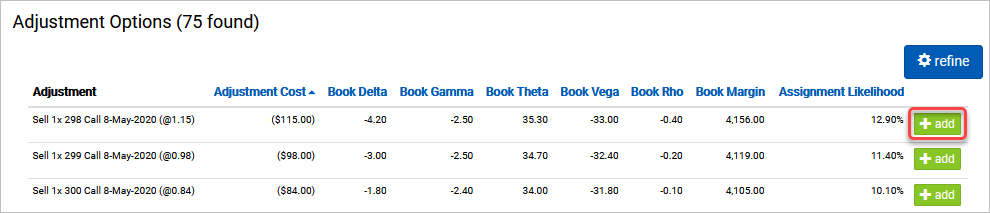

The book manager located 75 single-leg trades that met our search requirements. The list can be sorted to rank trades by cost/credit, resultant book Greeks, or assignment risk. Clicking Add will add that transaction to the pending book.

Click Add for the Sell 1x 298 Call 8-May-2020.

Scroll up to the Pending Book.

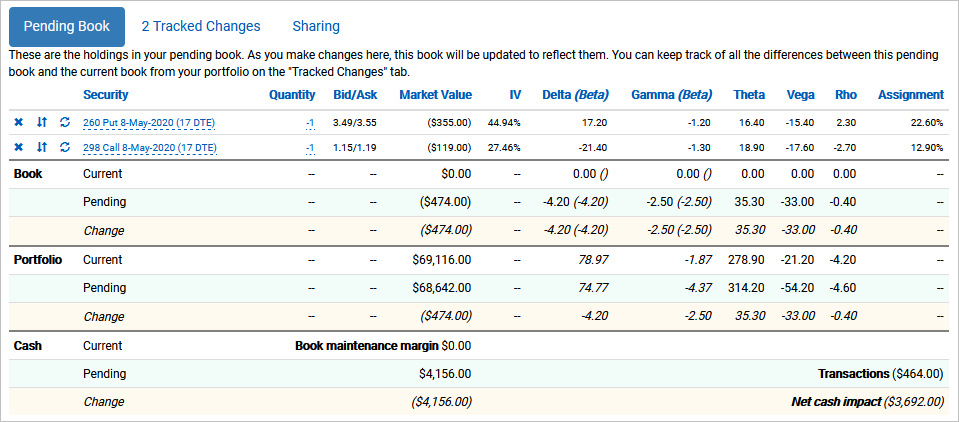

The pending book now shows 2 Tracked Changes, even though they were produced from different tools in Quantcha. If you added additional positions through any of these methods, they’ll all be combined and tracked to ensure an efficient execution plan. The book properties now also match the expected values shown in the trade adjustment search results.

The book maintenance margin has risen slightly from $4,021 to $4,156. This isn’t because the call added $135 in margin, but rather because the naked short call has its own margin of $4,156. Since it’s not possible for both the short put and short call used here to end in the money, the higher of the two is used as the margin requirement. Remember that naked short margins are dynamic and will regularly change based on market conditions and your brokerage’s policies. As a result, you will want to have plenty of extra cash on hand to avoid a margin call.

The transaction credit also increased from $349 to $464. This additional $115 comes from the call sale. This is a pretty solid addition relative to the comparable margin increase. Unfortunately, being naked short on both legs of this trade means that you’re open to substantial risk on a significant move in either direction. You can better understand this by checking out the updated P&L.

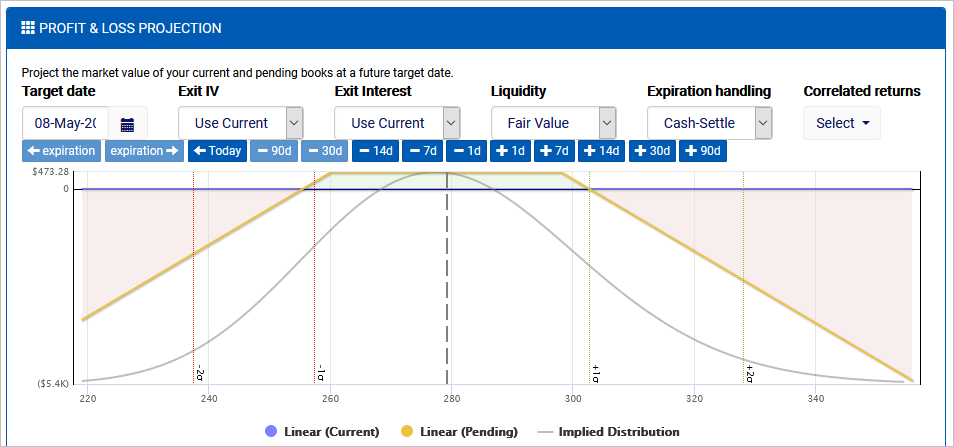

Scroll up to the Profit & Loss Projection.

The P&L provides a nice visual to express the payoff for this trade at expiration. It shows that the trade is expected to be profitable as long as the underlying stays within a 1-vol (standard deviation) move. Of course, you will likely revisit this book regularly to adjust it in accordance with your trade plan. You will probably also want to set up some Quantcha Alerts to notify you if the book exceeds your ideal delta or gamma ranges.

One important thing to note is that we used an option trade to hedge delta in this scenario. Another way to hedge delta is to trade underlying shares. Shares, by definition, have a delta of 1 and no impact on other Greeks. That means we could have alternatively hedged the 17.20 delta down to 0.20 by shorting 17 shares of SPY.