What is the book manager?

Suppose you’re trading an option strategy and it’s time to adjust it. Your scenario could be rolling out a covered call, selling more volatility against a current position, or balancing a delta-neutral book. Whatever your circumstances, you need all the help you can get in finding, modeling, and optimizing any changes you’re considering for your book. The book manager fills a major void in options trading. It provides the bridge between the book you currently have and the book you want moving forward.

Before we move ahead, let’s take a moment to define some key terms that are used throughout Quantcha:

- A position or holding represents a specific quantity of a security in your account. For example, a covered call would be two positions or holdings: the underlying stock and the short call.

- A book refers to all positions or holdings that accrue to the same underlying instrument. In most cases, the sum of positions in a book represents a single strategy, but it doesn’t always have to. For example, it’s possible to have a covered call strategy along with an unrelated put spread.

- A portfolio represents all books held under the same account. Quantcha offers a built-in “Paper” portfolio designed to be used for tracking your portfolio from an unsupported brokerage. If you have a linked brokerage account, then your portfolios will be imported for each account tied to the brokerage profile you linked with.

- A trade describes a transaction of one or more legs you are considering. Once a trade is placed and fills, its legs are added to (or subtracted from) your positions.

Why do I need a book manager?

The book manager serves four major functions for options investors.

Future value simulation

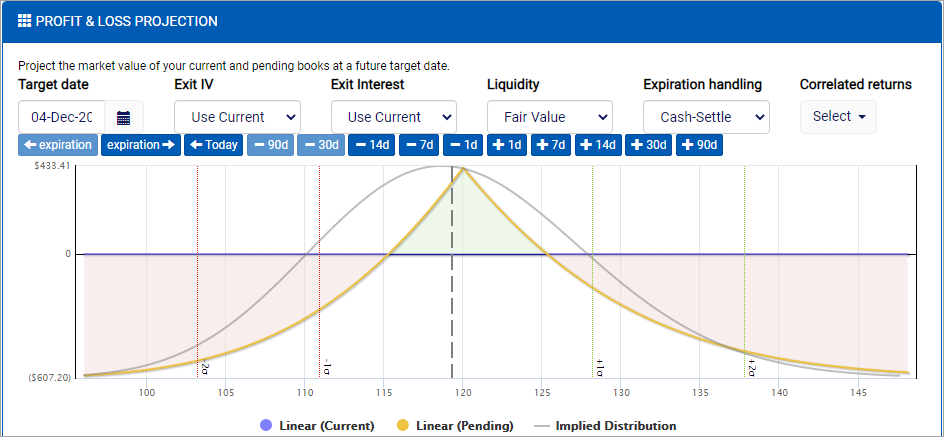

The book manager makes it very easy to model the future value of your options book using a wide range of configurable inputs. This means that you have a much better idea of how changes in different option pricing parameters (underlying price, days until expiration, interest rates, and implied volatility) will impact your holdings. This can be exceedingly difficult to manage by hand as books become more sophisticated, so having this work calculated automatically will drastically speed up your process.

Side-by-side experimentation

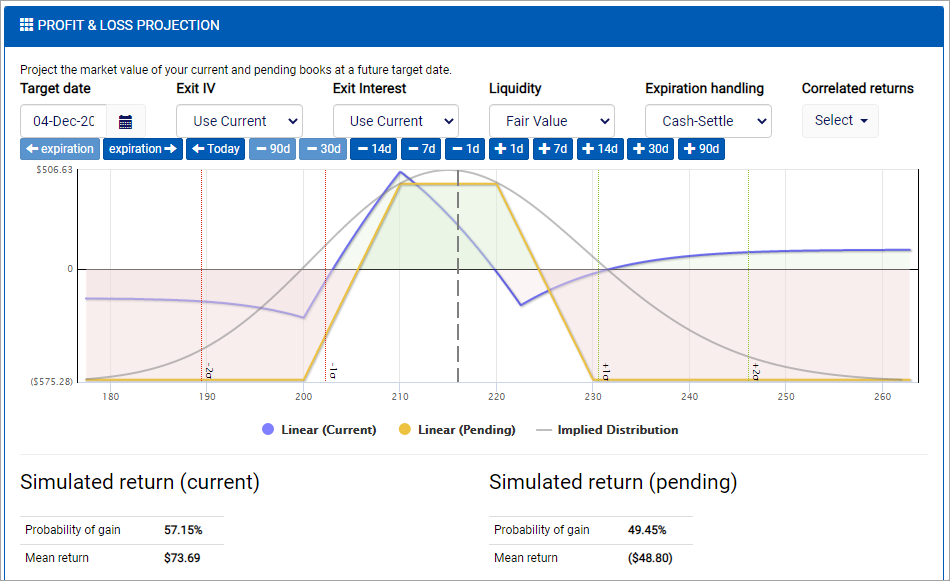

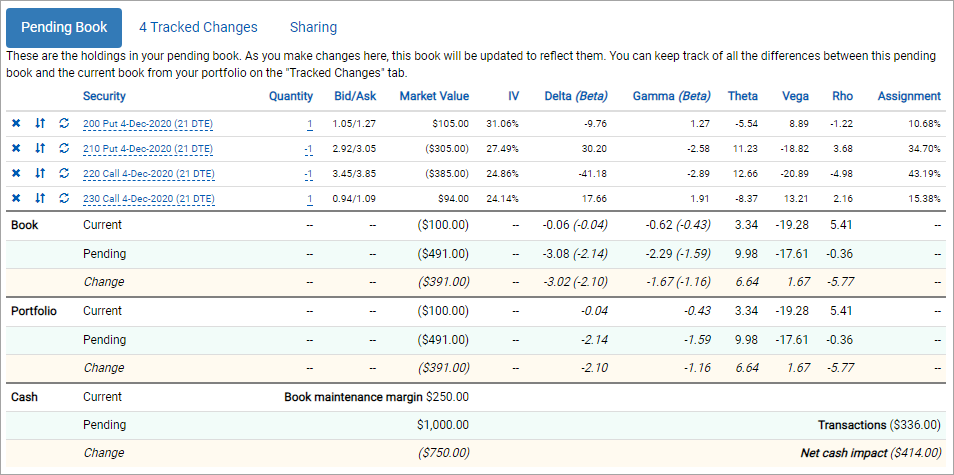

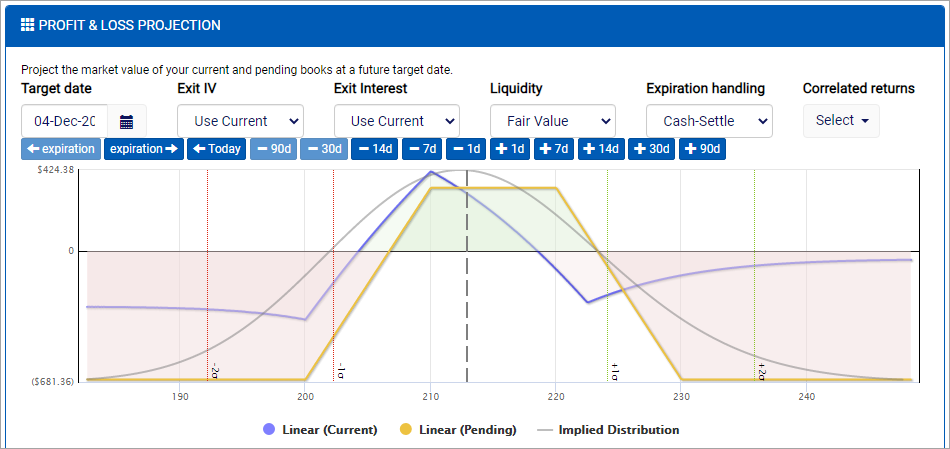

The book manager tracks two sets of positions: current and pending. By default the book manager loads with your current holdings, which are the positions you already have in your book. You can then experiment with the book manager to add, remove, and adjust your positions to find a target state. These new positions are tracked as your pending book.

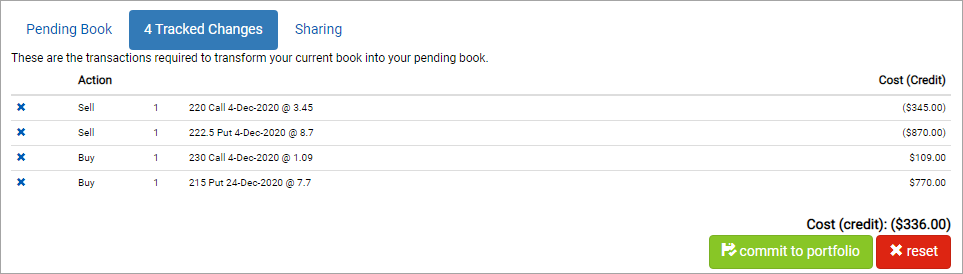

As you make these prospective changes, the book manager tracks both books so that you can compare and contrast how both look as future dates, as well as how their key metrics (market value, margin, and Greeks) align with your goals for the book and overall portfolio. At any point you can use the Tracked Changes tab to find the most efficient transactions to get from your current book to your pending book.

As you make changes to your pending book, you can easily review how it impact future returns relative to the current book using the overlaid profit & loss projection.

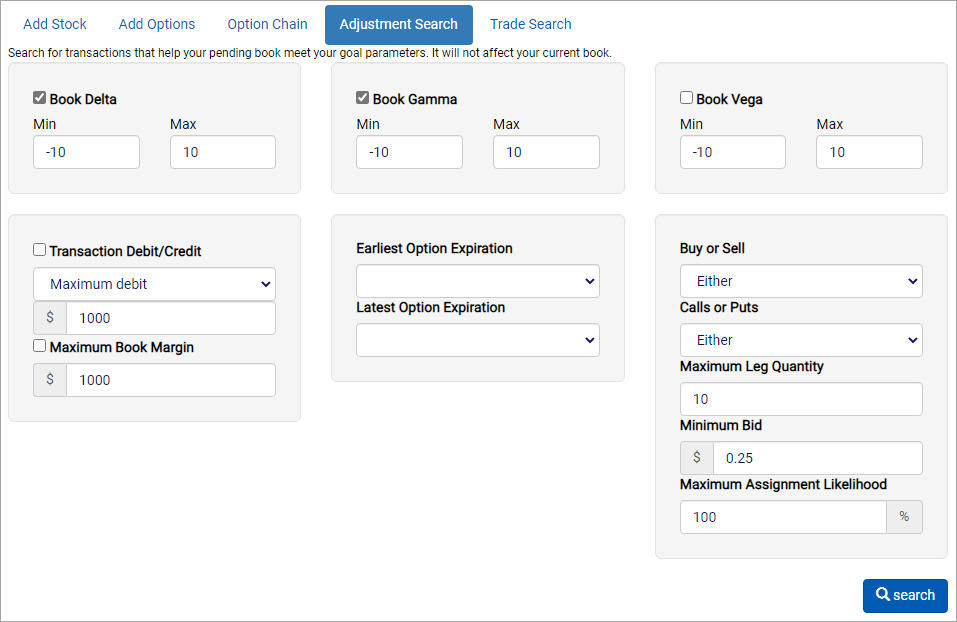

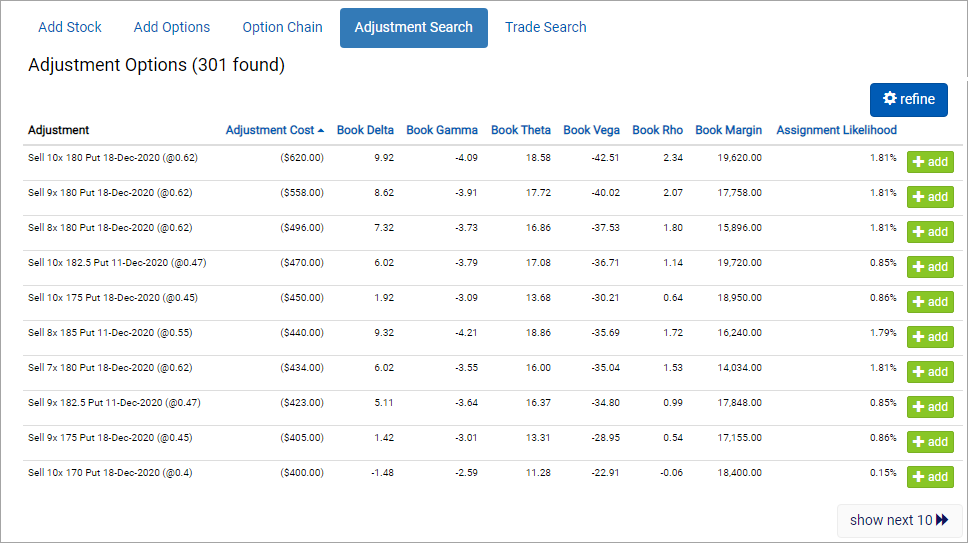

Automated adjustment search

Some sophisticated option strategies focus on maintaining a target range of Greeks, such as delta and gamma. Those investors will buy or sell options primarily on how well those options help them fit their targets. Sometimes these goals are met through trade search or charting, but sometimes investors are just looking for a quick single-leg trade to balance their book.

To support this, the book manager includes an adjustment search feature that locates the optimal legs and quantities to meet the desired book state.

Calendar trading

Quantcha offers several tools for finding optimal trades, such as the options search engine and a multitude of global strategy-specific screeners. However, these tools are not optimal for calendar trades, which are those including option legs with different expirations. Instead, it’s recommended that investors use those tools to locate opportunities at one expiration that are then hedged or otherwise balanced using the features of the book manager.

In the remainder of this course you will walk through the process of using each of the above features to manage an options book.