Exercise: Creating a portfolio event alert

In this exercise you create an alert using a Portfolio event condition so that you can be notified when one of the underlying stocks you have a position in approaches a milestone, such as an earnings announcement or ex-dividend date. These are important events to keep track of since they can significantly impact your investment.

The portfolio event condition doesn’t take any parameters to specify a book or symbol. Instead, it looks at all the positions you hold in the target portfolio and evaluates each for the specified event. This means that you don’t need to create individual alerts for each stock. As soon as a new underlying becomes part of your portfolio, the alert will include it in evaluation. However, each condition only tracks a specific portfolio. If you have multiple portfolios under the same linked brokerage account, you will need to create separate alerts for each of those you want tracked.

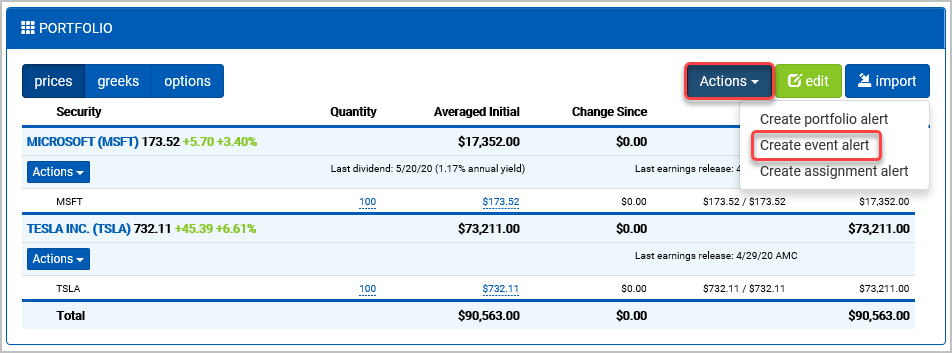

The exercise begins in the portfolio tracker for your Paper portfolio. If you don’t know how to get to the portfolio tracker, you can always use the Portfolio link at the top of the window to get there.

Select the Paper portfolio from the dropdown if it’s not already selected.

You now create an alert to receive notifications when an underlying in your portfolio is approaching its next ex-dividend date. There is a shortcut to create portfolio-level alerts from the Actions menu in the portfolio tracker. Note that these are similar to the book-level alerts you can create from the Actions menu under each underlying. In some cases, such as the alerts using Portfolio property conditions, they are the same alerts, but with different default configurations.

From the portfolio’s Actions dropdown, select Create event alert.

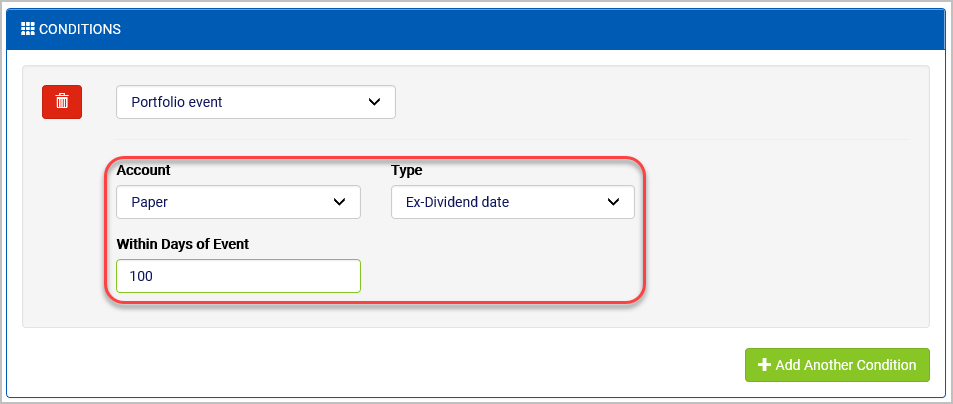

The alert editor opens a new alert set up with a Portfolio event condition set to the Paper portfolio it was created from.

For Type, select Ex-Dividend date.

For Within Days of Event, enter “100”.

Under normal circumstances, you’d probably want to select a shorter window to make sure that the notifications you received were more actionable. However, for the purposes of this exercise, we will use 100 days since it should guarantee a notification will raise within a few minutes of being saved. If you don’t end up getting a notification later on, try adding a different dividend-generating stock.

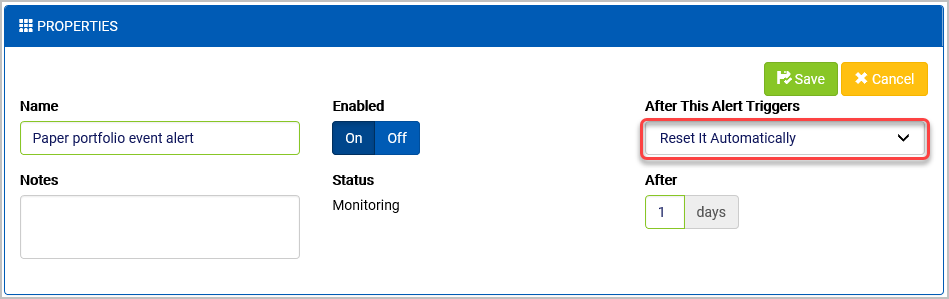

Since this is a portfolio event alert, it’s the kind of alert you would probably want to automatically reset itself. To do this, you just need to specify a post-trigger action before saving. Having an alert like this set up will help you remember to proactively manage in-the-money call positions as dividends approach.

From the After This Alert Triggers dropdown, select Reset It Automatically.

Select Save.

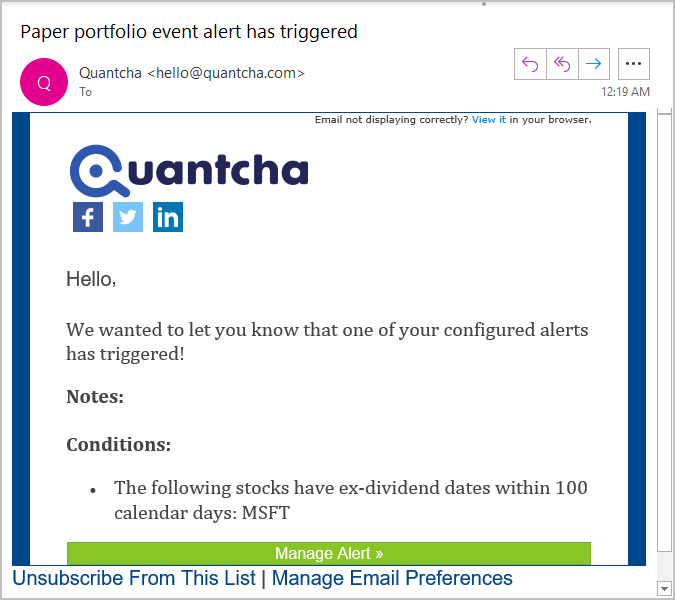

Watch your email for the notification. Review it once received.

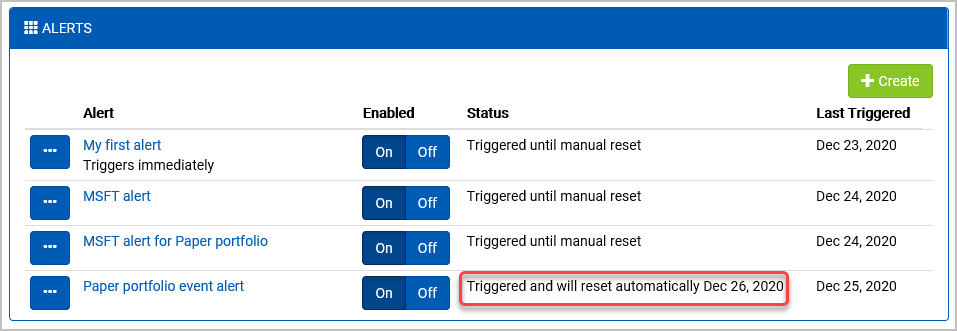

After the notification was sent, Quantcha Alerts automatically configures it to reset after the specified number of days.

Refresh the browser tab open to the list of alerts.

The alert’s status now indicates that it has triggered and will automatically reset on a specific date.