Exercise: Creating a multi-condition alert

In this exercise you create a multi-condition alert that combines an Option assignment condition with a Day and time condition to precisely control when an alert is evaluated. In this scenario, the alert is designed as a last-hour warning about any options you have at risk of assignment between 3-4PM ET on Fridays. It doesn’t cover every possible scenario where you could be at risk of assignment, but it’s useful in illustrating how a multi-condition alert can be created.

Note that this exercise will not immediately produce an alert notification as written because the trigger requirements are so precise. However, you can use the steps as a guideline for creating an alert that meets your current circumstances if you’d like to see it in action.

The exercise begins in the portfolio tracker for your Paper portfolio. If you don’t know how to get to the portfolio tracker, you can always use the Portfolio link at the top of the window to get there.

Select the Paper portfolio from the dropdown if it’s not already selected.

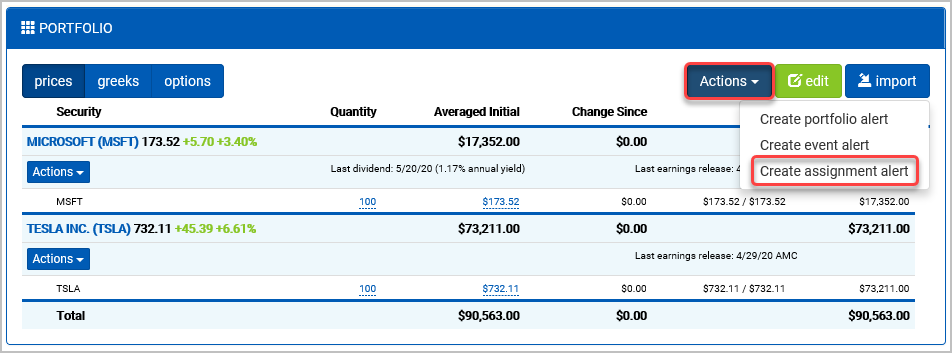

You now create an alert to receive notifications when your portfolio contains an option at risk of assignment due to an upcoming expiration or ex-dividend date. You again use one of the shortcuts under the portfolio’s Actions menu.

From the portfolio’s Actions dropdown, select Create assignment alert.

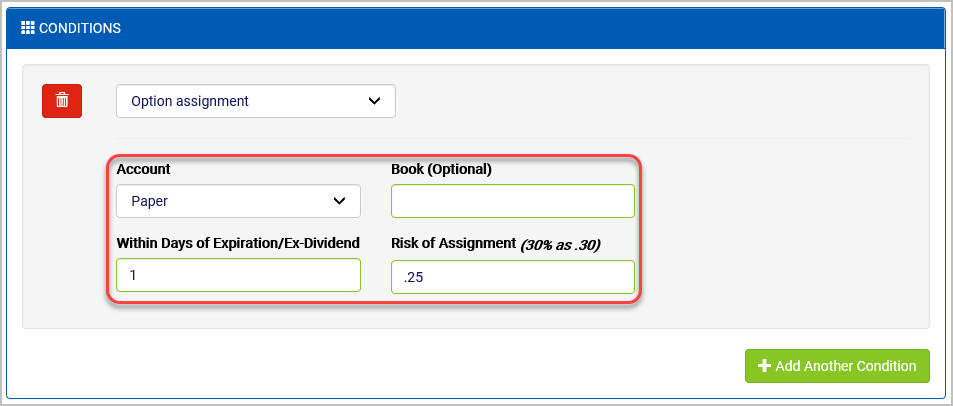

The alert editor opens to a default alert set up with an Option assignment condition set to the Paper portfolio. If you were only interested in alerts for a specific book you could specify that here using the Book field. Instead, you will configure the condition to check for options within 1 day of expiration (or ex-dividend) that have at lest 25% chance of being assigned.

For Within Days of Expiration/Ex-Dividend, enter “1”.

For Risk of Assignment, enter “.25”.

When the Option assignment condition is evaluated, it will use the likelihood of the option closing in the money as its risk of assignment. In other words, an option with a 25% chance of expiring in the money will be considered to have an assignment risk of 25%.

When evaluating for ex-dividend assignment, the calculations evaluate the assignment risk as the probability an in-the-money call will have time value worth less than the amount of the dividend. Both the expiration and ex-dividend evaluations happen automatically whenever the condition is evaluated.

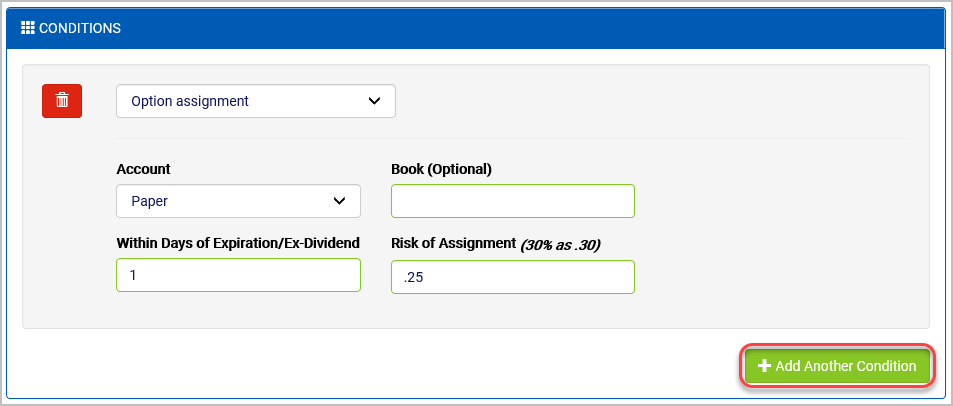

Since this alert is specifically intended to be checked only near the end of market on Fridays, you now add a Day and time condition to restrict the alert further.

Select Add another condition.

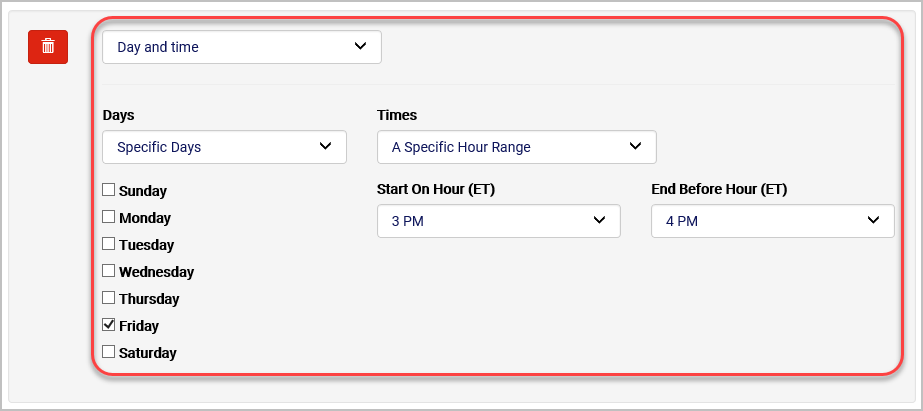

For Type, select Day and time.

For Days, select Specific Days and check Friday.

For Times, select A Specific Hour Range and select 3PM to 4PM.

All times are evaluated using the Eastern time zone to simplify planning.

Since this alert is a utility alert that should be run every week, it’s a good idea to have it automatically reset itself.

For After This Alert Triggers, select Reset It Automatically.

Select Save.

You can now expect a notification the next time it’s between 3-4PM Eastern on a Friday and you have an option with at least 25% likelihood of assignment within a day of expiration or ex-dividend. Pretty powerful, right?

How multiple conditions are evaluated

When an alert has multiple conditions, they are evaluated in a prioritized order to optimize for performance. Once one of the conditions fails, the alert evaluation exits without raising a notification.

Condition types are prioritized based on their relative load, so lightweight conditions are always evaluated first. For example, Day and time conditions have the highest priority, so they are always evaluated first. As a result, the alert created here will never check the Option assignment condition unless the Day and time condition is met first.

Conditions that require loading a single value, such as a stock price, have the next priority. Those that require loading your entire portfolio, such as checking for option assignment risk, have the lowest priority, so they are evaluated last.