Exercise: Creating a portfolio property alert

In this exercise you create an alert using a Portfolio property condition so that you can be notified when the target portfolio metric fits the criteria. You can use these to evaluate the market value of your portfolio, net Greeks like theta, or aggregate Greeks like beta-weighted delta.

There is also an optional condition parameter to specify a book. This enables you to limit evaluation to the holdings for a specific underlying within the portfolio, which is really useful when managing a delta-neutral book or tracking a set of positions for a desired closing price.

The exercise begins on the dashboard. If you are not on the dashboard, you can always use the Dashboard link at the top of the window to get there.

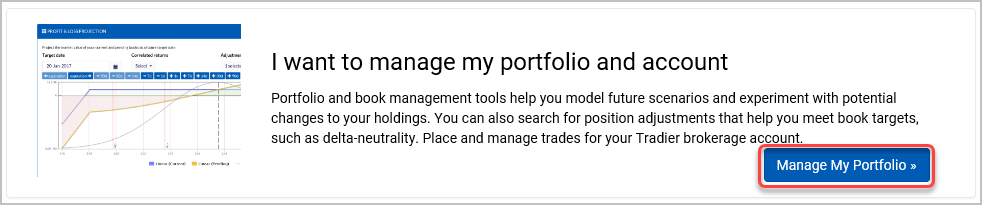

Locate the section that says I want to manage my portfolio and account.

The portfolio tracker provides an easy way to track the positions in the selected portfolio. By default, Quantcha provides a “Paper” portfolio, which is a disconnected set of positions stored in your Quantcha account. You may make any changes you want to this portfolio to either reflect a real-world account or for experimentation.

In this exercise you use the Paper portfolio to create an alert relying on a portfolio property condition. The process is the same for alerts based on linked brokerage accounts, so everything you do here applies to those as well.

Select the Paper portfolio from the dropdown if it’s not already selected.

The alert created in this exercise will target the MSFT book in your portfolio. If you are currently tracking positions in MSFT, you can swap its references for another stock in this exercise. Either way, you will need a starting position.

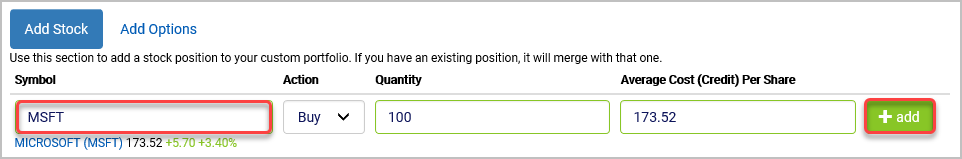

From the Add Stock tab at the bottom, enter “MSFT” as the Symbol.

Select Add to add the default 100 shares at the last price. It doesn’t really matter what the quantity or price are since the condition will just look for a positive number.

Repeat the process to add 100 shares of TSLA (you can skip this step if you already have a TSLA position).

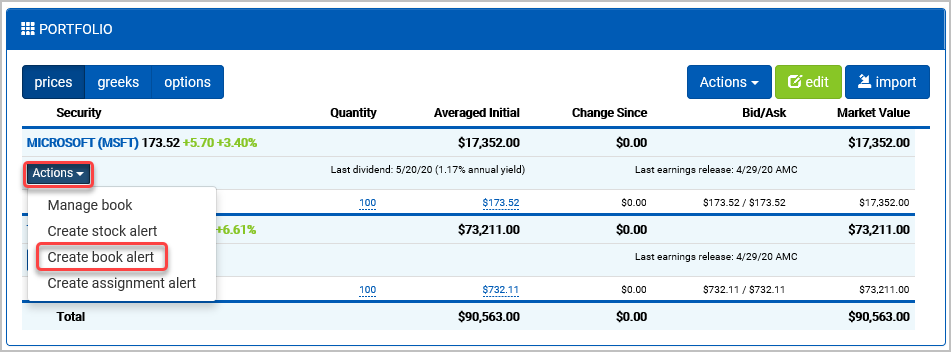

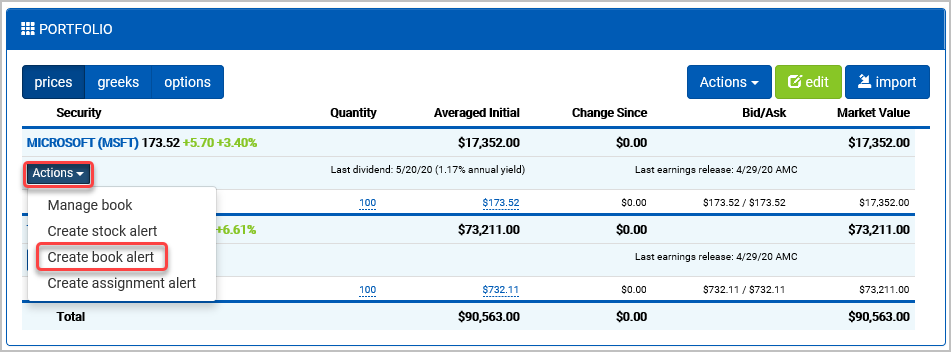

Now that the portfolio has some positions, it’s time to create the MSFT alert. There is a shortcut to create common alert types in the Actions menu below each underlying in the portfolio tracker.

From the Actions menu under MSFT, select Create book alert.

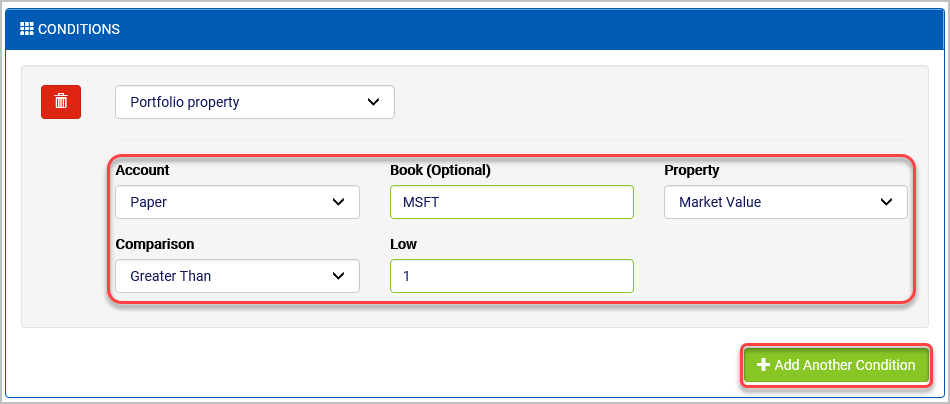

The alert editor opens to a default alert set up with a Portfolio property condition set to the Paper portfolio and the MSFT book. Note that these alerts will default to that specific book, whereas alerts created from the portfolio’s top-level Actions dropdown will evaluate the entire portfolio. You can easily adjust either of these using the Underlying field in the condition.

For Property, select Market Value.

For Comparison, select Greater Than.

For Low, enter “1”.

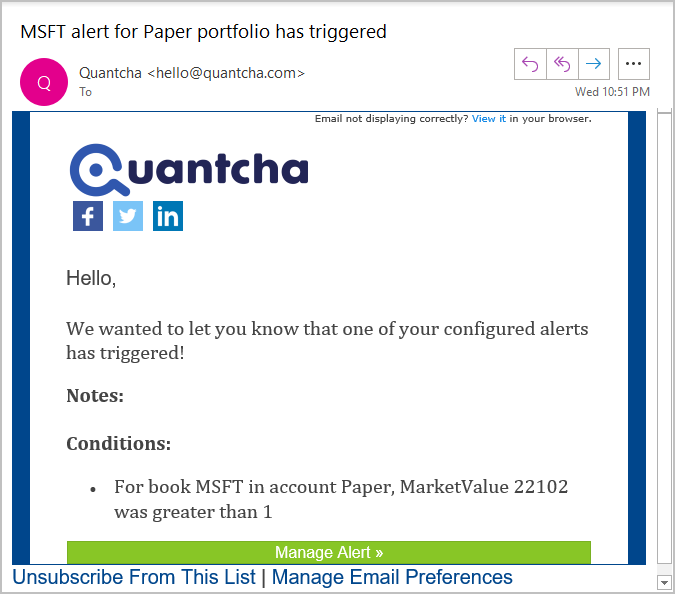

After being saved, this alert will trigger once the market value of your MSFT book exceeds $1. Since it’s pretty likely that’s already the case, it will trigger the first time it’s evaluated, which should be within five minutes. The market value is positive here because the book is long 100 shares. If the position were short shares instead, you’d need to account for the negative market value. For complex option positions, market values can be positive or negative, depending on the circumstances.

Select Save.

Watch your email for the notification. Review it once received.

There are a lot of interesting scenarios where Portfolio property conditions can be employed. Here are a few ideas to get you started:

- If you are trading a net debit position, you can set up a notification to let you know when the market value of your book reaches a target price so you can sell to close.

- If you are trading a net credit position, you can set up a notification to let you know when the cost to close reaches a target profit. For example, an alert for the book’s market value being greater than -100 will let you know when you can buy to close the position for less than $100.

- If you are managing a delta-neutral book, you can set up an alert to notify you when the net delta for a book is outside your target range. You could optionally set up a second alert with a condition to let you know when the net gamma is outside a target range for that property, if you want to track that as well.

- If you are working to keep your portfolio hedged such that it avoids too much correlation with the S&P 500, you can set up an alert to notify you when the portfolio’s beta-weighted delta is outside your desired range.

- If you are trying to generate consistent income from time value decay, you can set up an alert to track theta on your portfolio or book. When theta falls below a desired threshold, you’ll know it’s time to adjust your books.